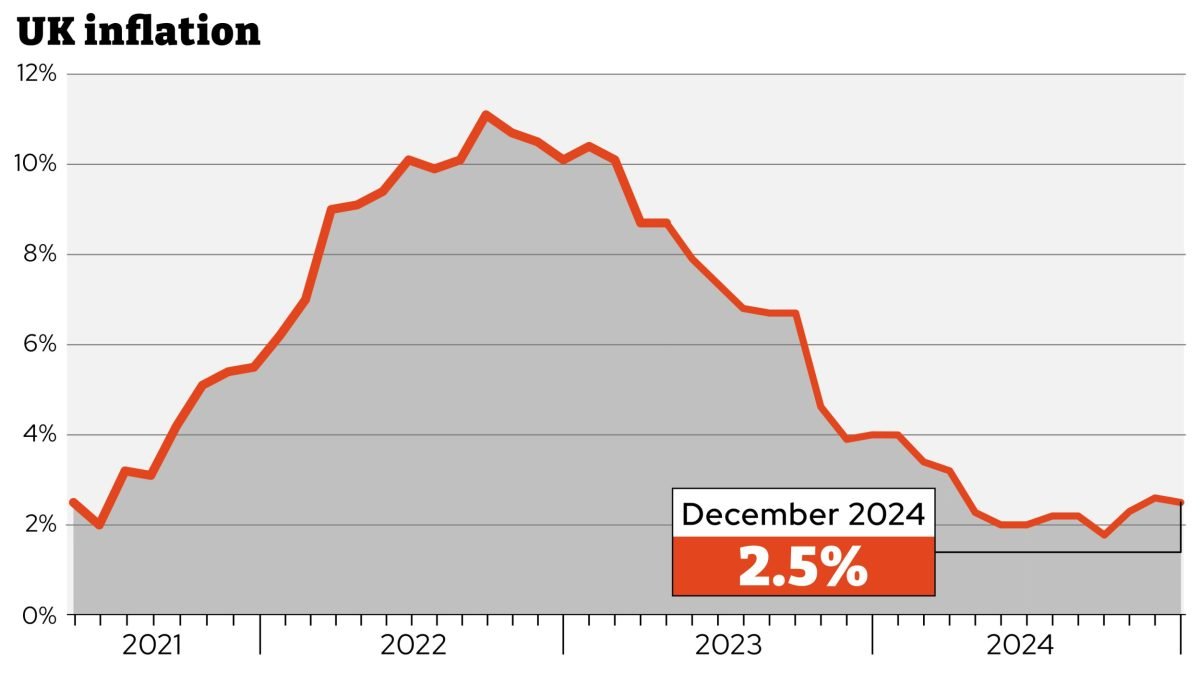

Despite experts predicting inflation will rise over 2025, December’s figure fell to 2.5 per cent

Inflation fell to 2.5 per cent, according to figures released by the Office for National Statistics (ONS) on Wednesday.

This is down from November’s level of 2.6 per cent despite experts predicting it would hold at this level, if not rise slightly.

However, the Consumer Prices Index (CPI) measure of inflation for December has remained above the Bank of England’s two per cent target.

Core inflation, which excludes energy, food, alcohol and tobacco, rose by 3.2 per cent, down from 3.5 per cent in the previous reading.

Services inflation fell from 5 per cent to 4.4 per cent. This is a figure watched closely by the Bank when deciding whether to cut interest rates or not.

The largest downward contribution to inflation rates came from restaurants and hotels which fell to 3.4 per cent, down from 4 per cent in November.

Meanwhile, the largest upward contribution came from transport where prices fell by 0.6 per cent, compared with a fall of 1.1 per cent in November.

Despite a fall, inflation is expected to increase throughout the year.

Chancellor Rachel Reeves said: “There is still work to be done to help families across the country with the cost of living. That’s why the Government has taken action to protect working people’s payslips from higher taxes, frozen fuel duty and boosted the national minimum wage.

“In our Plan for Change, we were clear that growth is our number one priority to put more money in the pockets of working people. I will fight every day to deliver that growth and improve living standards in every part of the UK.”

It comes on the back of higher borrowing costs that could force the Chancellor to deliver a mini-Budget later this year.

The yield on benchmark 10-year UK gilts – which reflect the cost of borrowing – climbed to its highest point since the 2008 financial crisis last week.

This is partly a result of sticky inflation, keeping interest rates higher for longer, alongside higher US rates and supply pressures.

What is expected to happen to inflation in future?

It is widely expected that inflation will increase throughout this year with many expecting it to reach 3 per cent or more.

The Office for Budget Responsibility, which acts as a watchdog for the Treasury, said in October that the Chancellor’s Budget would increase inflation, partly because some of the rise in employer national insurance contributions would be passed on to consumers in the form of higher prices.

Robert Wood, chief economist at Pantheon Macroeconomics, said: “Inflation should rebound in the new year and rise to 3.1 per cent in April.”

Sanjay Raja, chief UK economist at Deutsche Bank, added: “A central hypothesis of ours is that headline CPI will reverse course in 2025 – albeit temporarily. We see price momentum rising to around 3 per cent.”

Why is inflation expected to rise?

One reason inflation is expected to increase is higher energy prices. Gas prices have soared recently – something households will be watching closely.

Ofgem’s price cap has already registered two consecutive quarterly increases. After a 10 per cent rise at the end of last year, annual average dual fuel bills rose by a further one per cent in January.

Mr Raja said: “Natural gas prices have picked up considerably on the back of cooler temperatures, lower storage levels, and the stoppage of Russian gas flows into Western Europe via Ukraine.

“Our models now point to a hefty spring increase of near 7 to 10 per cent should gas and electricity futures prices remain steady for the next month or so.”

There has also been an increase in food prices and the rise in national living wage and the rise in employer national insurance contributions is expected to add to retail prices.

Mr Raja said he also expects to see continued services inflation keeping headline inflation above-target.

“Increases in both the living wage and payroll taxes will likely lift inflation in low-margin services sectors such as hospitality and leisure. We also see rents inflation taking longer to unwind after rising by 8 per cent in 2024.”

What does it mean for interest rates?

Lower inflation means prices are rising more slowly and can prompt the Bank of England to lower interest rates.

The reading may impact the Bank of England’s next base rate decision in February. Currently, experts are divided over whether there will be a cut from the current rate of 4.75 per cent or another hold.

If there is a rate cut next month, it is then expected there will only be a handful of cuts throughout the year.

What do higher inflation and interest rates mean for your money?

Mortgages

Lower inflation and interest rates are good news for mortgage borrowers as it often leads to rates falling.

However, mortgage rates are currently expected to rise due to the worsening economy, experts have warned, causing a “significant challenge” for Rachel Reeves.

They have been gradually rising this year as swap rates, which underpin the pricing of fixed-rate mortgages, have edged upwards and are increased by increases in the cost of government borrowing.

Virgin Money upped rates by 0.2 percentage points today whilst Co-Op is increasing fixed rates by 0.59 percentage points on Thursday (16 January).

Aaron Strutt, of brokers Trinity Financial, said: “It seems likely there are mortgage price hikes on their way. With all of the uncertainty in the economy and pretty harsh tax changes announced in the Budget, mortgage borrowers are set to end up paying more and for longer.

“In the short term, it looks likely rates are going to be higher than they were pre-Budget.”

The average two year fixed rate is 5.49 per cent whilst the average five year deal is 5.27 per cent, according to Moneyfacts.

Savings

Lower interest rates also often translate to lower savings rates.

Currently, there is strong competition in the easy access market where you can get up to 5 per cent.

However, experts are warning people to lock in rates now before they start to come down.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “If your provider has cut its rate, it’s a reminder that there are still decent deals on offer, so it pays to vote with your feet and switch to an online bank or savings platform where you tend to get more competitive deals.”

The best rate currently available is a Cash ISA with Trading212 with a return of 5.05 per cent.

Pensions

Higher inflation can eat into pensioners’ savings so lower inflation will mean they have more in their pocket.

However, another factor to be aware of is the impact of inflation on annuity rates.

Annuities offer a guaranteed annual income in retirement. They offer an alternative to drawing down money from a pension pot, which could eventually run out, particularly if a retiree lives longer than expected.

While they have been unpopular in recent years, rising interest rates have improved the annual incomes someone can buy.