Florida’s Citizens Property Insurance Corporation, the state’s insurer of last resort, is aiming to purchase $2.94 billion of new traditional reinsurance and catastrophe bonds for the 2025 hurricane season, which would take its total risk transfer to $4.54 billion this year.

There is $1.1 billion of aggregate reinsurance limit available from the Everglades Re II Ltd. (Series 2024-1) cat bond that Florida Citizens sponsored in 2024, which will run through both the 2025 and 2026 wind seasons for the insurer.

In addition, Citizens still has $500 million of industry-loss based reinsurance from its Lightning Re Ltd. (Series 2023-1) cat bond that it sponsored in 2023 and which will provide coverage through the next hurricane season only, maturing early next year.

The cat bond program has provided the insurer with added certainty from its multi-year protection, on top of which it will now venture into the market to secure additional reinsurance or cat bonds up to the targeted $4.54 billion of limit.

To secure the necessary risk transfer and reinsurance protection for 2025, Florida Citizens said it is budgeting for approximately $650 million of premiums.

For 2024, the insurer had budgeted $700 million initially, compared to a projection of $695.2 million for for 2023.

The decline in premium ceded that is being budgeted for comes with the reduction in exposure Florida Citizens has experienced, as its depopulation program has taken greater effect in the last year.

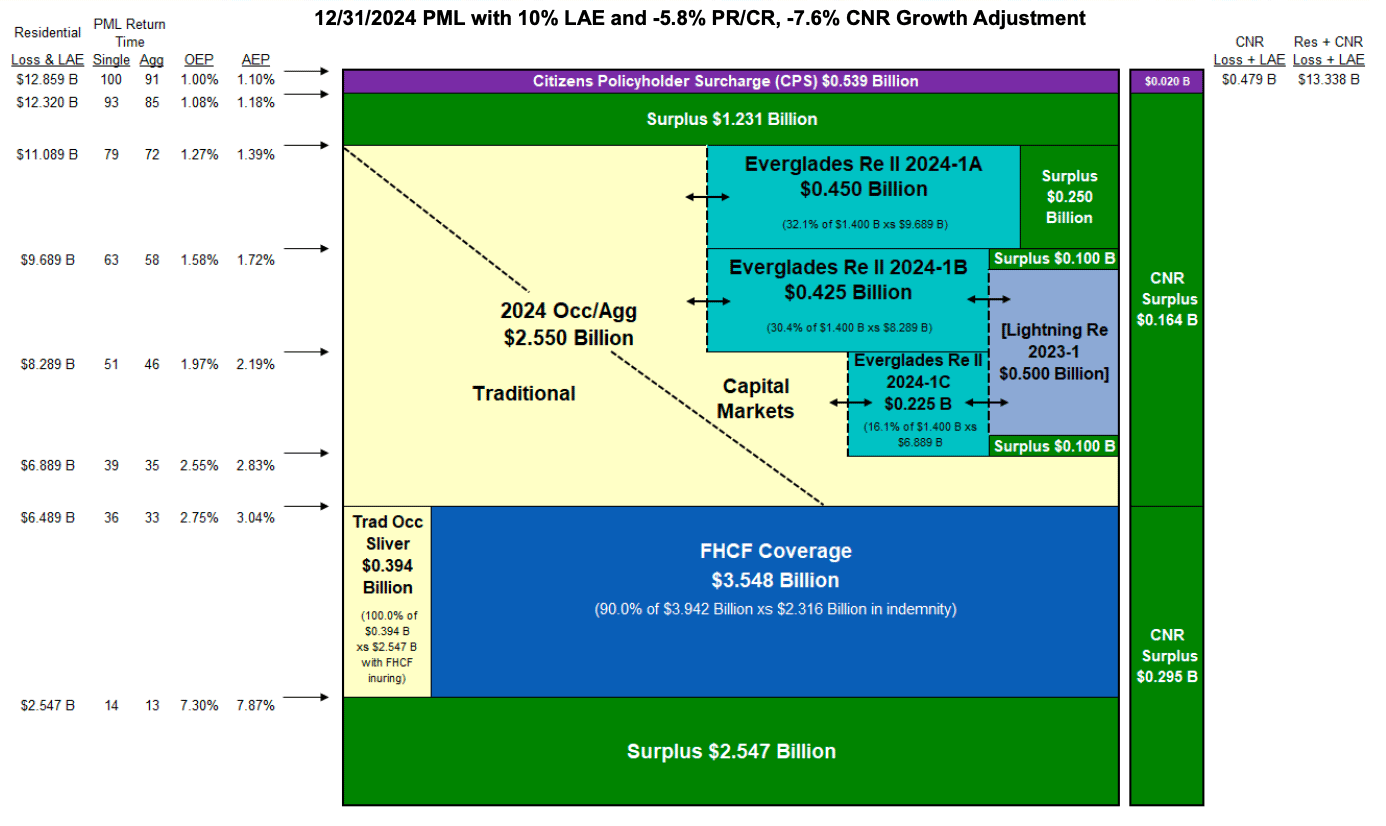

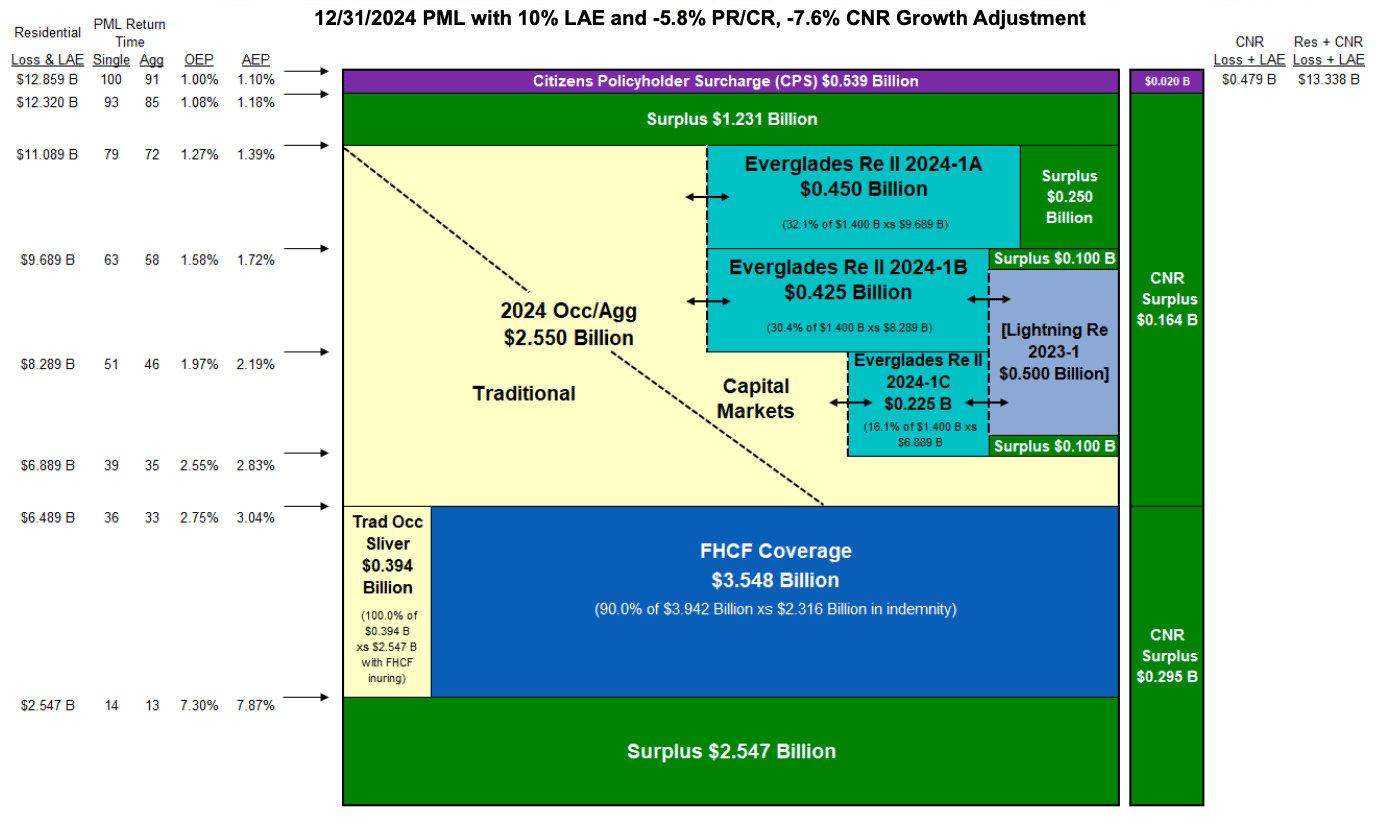

Because of this reduced level of exposure, the 1-in-100 year PML is estimated at around $12.86 billion as of the end of 2024, compared to an over $17 billion projection it had for that figure in late 2023.

Recall that, Florida Citizens had reported its policy count as falling below 1 million by the end of November 2024. That decline has continued, with the figure dropping to 847,571 policies by the end of February 2025 and so the exposure-base falling commensurately.

Florida Citizens staff as a result propose buying total risk transfer of $4.54 billion, with the $1.6 billion of in-force catastrophe bond protection and $2.94 billion of new private risk transfer, made up of both traditional reinsurance and catastrophe bonds.

Some of the traditional reinsurance may also be from collateralized sources, as it’s typical that ILS funds participate in these layers as well.

In fact, at its 2024 renewal Florida Citizens secured almost $1.3 billion of protection that came from insurance-linked securities (ILS) and collateralized markets participation in its traditional reinsurance tower.

The 2025 risk transfer tower is expected to feature a traditional reinsurance sliver layer that sits alongside and works in tandem with the mandatory coverage provided by the Florida Hurricane Catastrophe Fund (FHCF) amounting to $394 million.

FHCF coverage is projected to be $3.548 billion in size, down on the $5.02 billion utilised for 2024, again due to the reduction in exposure.

Above that will sit a layer featuring the $1.6 billion of in-force catastrophe bonds and roughly $2.55 billion of new reinsurance and cat bonds procured for 2025, which will all be annual aggregate in nature.

You can see the proposed 2025 risk transfer tower for Florida Citizens below:

Beneath the private market risk transfer the surplus has been eroded compared to last year, effectively meaning reinsurance cover could attach from a projected $2.547 billion of losses in 2025.

At its 2024 reinsurance renewal, the Florida Citizens tower had $3.154 billion of surplus sitting in the bottom layer.

If Florida Citizens is successful in placing the targeted $2.94 billion of new reinsurance and cat bonds, giving it $4.54 billion of private market risk transfer, it says that it would expose all of its surplus and have a potential Citizens policyholder surcharge of $559 million for a 1-in-100-year event in 2025.

Citizens staff are now engaging with brokers, advisors and market participants to design, structure and price its reinsurance and catastrophe bond placements for 2025.

It’s worth remembering though, that Florida Citizens had targeted $5.5 billion of reinsurance and risk transfer in advance of the 2024 hurricane season, but only ended up buying just under $3.6 billion as it found pricing too high to maximise its protection last year.

Citizens explained that its proposed risk transfer tower for 2025, “is structured to provide liquidity by allowing Citizens to obtain reinsurance recoveries in advance of the payment of claims after a triggering event while reducing or eliminating the probabilities of assessments and preserving surplus for multiple events and/or subsequent seasons.”

Given the attractive execution seen in the catastrophe bond market for recent deal sponsors, it’s anticipated that Florida Citizens could come to market with another large new issuance in the coming weeks.