In a sign of stress in the agriculture sector, scheduled commercial banks, excluding regional rural banks (RRBs), have seen a sharp increase of 42 per cent in bad loans Kisan Credit Card (KCC) accounts, a revolving cash credit facility offered to farmers, in the last four years.

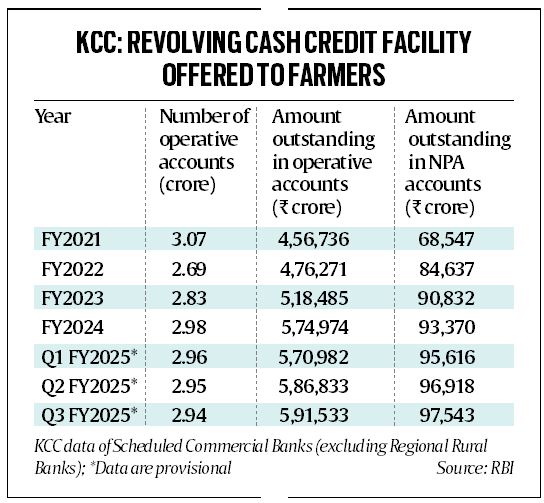

The outstanding NPA amount in the segment surged to Rs 97,543 crore as at end of December 2024, compared to Rs 68,547 crore at end of March 2021, the Reserve Bank of India (RBI) said in its reply to the Right to Information (RTI) request filed by The Indian Express.

The NPA amounts in the KCC segment stood at Rs 84,637 crore in FY2022, which rose to Rs 90,832 crore in FY2023 and to Rs 93,370 crore in FY2024. The amount of NPAs in the KCC scheme stood at Rs 95,616 crore in the first quarter of the fiscal 2025, and Rs 96,918 in July-September 2025 quarter.

The NPA classification in the KCC segment is different from other retail loans, where an account becomes an NPA if interest and instalment of principal remain overdue for more than 90 days. The repayment period for KCC loans is as per the crop season (short or long) and marketing period for the crop. The crop season for states is decided by the respective State Level Bankers Committee (SLBC). For short duration crops, the crop season is 12 months and for long duration crops it is 18 months in most states.

Bankers said if a KCC loan is not paid within three years of disbursal, it will be classified as NPA.

In the period between the end of FY2021 and the end of December 2024 quarter, the outstanding loan amount in operative KCC accounts of banks has also grown by nearly 30 per cent. The outstanding amount in operative KCC accounts surged to Rs 5.91 lakh crore as of December 2024 from Rs 4.57 lakh crore as at the end March 2021. The amount outstanding in operative KCC accounts of banks stood at Rs 4.76 lakh crore in FY2022, Rs 5.18 lakh crore in FY2023 and Rs 5.75 lakh crore in FY2024.

In the first quarter of FY2025, the total amount outstanding in operative KCC accounts stood at Rs 5.71 lakh crore, which slightly rose to Rs 5.87 lakh crore in Q2 FY2025.

Story continues below this ad

The figures for NPA amounts and the outstanding amount in operative KCC accounts for the first three quarters of the current fiscal (FY2025) are provisional, the RBI said.

Introduced in 1998, the Kisan Credit Card (KCC) scheme provides adequate and timely access to credit to farmers for agricultural and other allied activities. KCC offers a revolving cash credit facility to farmers, without any restrictions on the number of debit or credits. KCC loans are part of the overall agriculture loan book of banks, which comes under the priority sector lending (PSL) book of banks. Of the overall PSL target of 40 per cent, banks are mandated to achieve an agriculture target of 18 per cent.

Experts attribute the rise in defaults in the KCC segment of scheduled commercial banks to various factors including inability of farmers to repay loans due to weather-related damages to crops, lack of awareness among farmers about repayment timelines, delay in payments due to exigencies related to personal household requirement, and weak loan recovery mechanism for banks.

“NPAs (amount wise) are high (in KCC loans). Among all other agriculture loans offered by banks, such as tractor or food and agri-processing loans, the highest amount of delinquencies are seen in the KCC segment,” said a banker.

Story continues below this ad

Defaults are higher in the KCC segment where the amount borrowed is much lower compared to other agricultural loans, and so, repayment becomes the last priority for a farmer.

Since agriculture is subject to the vagaries of weather, any natural calamity can affect crops. In such cases, inadequate crop insurance or no crop insurance, owing to higher premium, also impacts farmers’ loan repayment capabilities.

Besides, expectations of farm loan waiver ahead of any state election often distorts the repayment behaviour of farmers in hope of some relief from the government, bankers said.

When it comes to recovery of agricultural loans, even banks go slow as any harsh step could stir up a hornet’s nest, since it becomes a political subject. “The recovery measures which banks can adopt (in KCC loans) are also limited compared to other retail loans. In case of a housing or an SME loan, the moment it becomes an NPA, banks can recover loans by selling the property taken as collateral. This kind of mechanism is not possible in an agricultural loan,” said a former banker.

Story continues below this ad

Farmers’ suicides further deter lenders from taking aggressive recovery steps in case of defaults.

Under the KCC scheme, farmers can draw the credit limit using various delivery channels such as ATM/debit card and business correspondents. The card is valid for five years.

The Centre, under Modified Interest Subvention Scheme (MISS), provides interest subvention of 1.5 per cent to banks for providing short-term agriculture loans through KCC up to Rs 3 lakh at a concessional interest rate of 7 per cent per annum. An additional prompt repayment incentive of 3 per cent is provided to farmers on timely repayment of loans, which effectively reduces the rate of interest to 4 per cent for farmers.

In the Budget 2025-26, Finance Minister Nirmala Sitharaman had announced to increase the loan limit under the MISS from Rs 3 lakh to Rs 5 lakh.

Story continues below this ad

Loans up to Rs 2 lakh are extended on a collateral-free basis, ensuring hassle- free access to credit for small and marginal farmers.

In terms of states, Uttar Pradesh had the maximum outstanding amount under the KCC scheme across all banks (SCBs, cooperative banks and regional rural banks), in 2024, at Rs 1.38 lakh crore, as per the RBI data. This was followed by Rajasthan (Rs 1.08 lakh crore), Madhya Pradesh (Rs 84,523 crore), Maharashtra (Rs 78,018 crore), Gujarat (Rs 71,132 crore) and Karnataka (Rs 62,794 crore).

A 2019 report of an RBI working group to ‘Review Agriculture Credit’ had said that loan waivers do impact the credit flow to agriculture due to moral hazard among both beneficiaries and non-beneficiaries of the bailout. This impact could be both in loan performance, as borrowers choose to default strategically in anticipation of future bailouts, and in credit allocation, as banks reallocate lending to lower risk borrower segments.