A cash expert has exposed a major problem with the Reserve Bank’s proposed ban on surcharge fees on debit and credit card transactions.

The Reserve Bank of Australia’s review of merchant card payment costs recommends the fees be scrapped on EFTPOS, Mastercard and Visa card transactions because they don’t help consumers.

It said lowering the cap on fees paid by businesses would save Australians $1.2billion or $60 for every card-using adult.

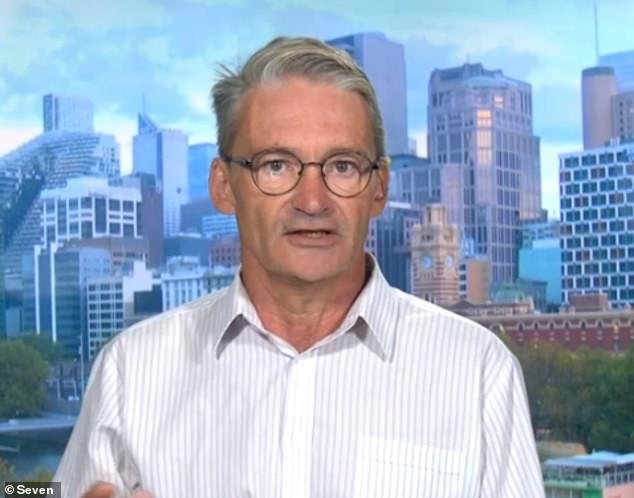

But cash campaigner Jason Bryce, 58, has called the plan a ‘disaster,’ claiming it paves the way for hidden costs to be quietly baked into product prices.

‘They’re going to hide that cost and everybody’s going to pay and it doesn’t matter whether you bring a card, a phone or cash to the shop.’

Mr Bryce, who started a campaign during the Covid pandemic to give a voice to Australians who rely on cash, said the RBA proposal is ‘un-Australian’.

He said the current system was fairer because it clearly separated card fees from the cost of goods.

Under that system, Australians who paid with cash or bank transfer avoided the extra surcharge, while only those who chose to pay with a debit or credit card were charged the additional fee.

Cash campaigner Jason Bryce has warned that removing visible fees won’t eliminate them -they’ll just be quietly baked into the price of goods, hitting all shoppers regardless of how they pay.

Mr Bryce says the proposal will reduce transparency and lead to across-the-board price increases – even for those paying with cash.

‘These card surcharges are uniquely Australian. The Reserve Bank has caved in to Visa and Mastercard.’

He explained that if card fees are banned, the cost won’t disappear – it will just be included in the overall price of goods.

That means all Australians who pay cash will be footing the bill for the perks enjoyed by credit card users, like reward points, free gifts, and luxury travel deals.

‘Ordinary people are going to be paying for the rich’s benefits, the holidays, the concierge service, the free gifts,’ he told Daily Mail Australia.

‘The card schemes have got everything they’ve ever wanted.

‘They’re going to hide that cost and everybody’s going to pay and it doesn’t matter whether you bring a card, a phone or cash to the shop.’

The Australian Restaurant and Cafe Association slapped down the proposal, and suggested the ‘tone deaf’ policy would simply drive up menu prices.

‘Who the hell does the RBA think will bear the cost of this ridiculous decision?’ chief executive Wes Lambert said.

‘A blanket ban on surcharging will undermine small businesses, reduce price transparency and mandate price hikes across every menu in Australia.’

Consumers are estimated to pay $1.2billion in surcharges on payments each year, the equivalent of $60 per card-using adult.

The fee is paid by a business to a customer’s card issuer when a transaction occurs, with some passing that fee onto the customer.

Better transparency achieved by forcing card networks and large acquirers to publish what fees they are charging has also been recommended to foster competition between networks

Some Aussies argue the current system is more transparent, as card fees are visible and sometimes avoidable by paying cash

The Council of Small Business Organisations Australia said businesses would just raise their prices and the changes would hide, rather than remove, surcharges.

The Independents Payment Forum – a body that represents small businesses including retailers, cafes, service stations and convenience stores – said other merchant fees would still eat into profit margins.

‘The proposed regulatory options fail small businesses and the local communities they serve,’ co-founder Bradford Kelly said.

‘They benefit big business, big banks and big offshore companies.’

The RBA’s proposals go further than previous federal government suggestions and are likely to be pushed through by the central bank, pending the outcome of a short feedback window.

Treasurer Jim Chalmers had said the government was prepared to ban fees on debit card transactions from the start of 2026.

But the RBA has included credit cards.

The government will consider the recommendation, but Dr Chalmers on Tuesday noted the RBA expected to be able to make the changes under its existing powers.

RBA Governor Michele Bullock (pictured) said consumers and businesses would benefit from a ban on surcharge fees for debit and credit card transactions

The central bank proposed removing prohibitions on ‘no surcharge’ rules to achieve scrapping the fees.

It expected the card networks would then follow by implementing ‘no surcharge’ rules based on historical experience and arrangements in other jurisdictions.

If that did not occur, the RBA would recommend the government legislate to ban surcharge fees.

Canstar data insights director Sally Tindall said consumers were fed up with being slugged with extra fees at the checkout.

‘Our research shows the vast majority of Australians want this annoying bugbear off their backs for good,’ she said.

Banks and other payment systems backed the changes because they kept pace with the reality of the modern-day transaction.

‘It makes sense that consumers know the final price before they get to the checkout,’ an Australian Banking Association spokesperson said.

‘Banks will work with the government to provide Australians with more certainty and transparency on the costs of digital payments.’

RBA governor Michele Bullock said consumers and businesses would benefit as fewer and fewer Australians made cash payments.

‘The time has come to address some of these high costs and inefficiencies in the system,’ she said.

Lowering the cap on interchange fees by businesses is predicted to benefit small businesses the most, because they often pay higher fees.

The central bank found small businesses would be $185 million better off under the changes, with 90 per cent of them benefiting.

Better transparency achieved by forcing card networks and large acquirers to publish what fees they are charging has also been recommended to foster competition between networks.

Any changes won’t kick in until July 2026.