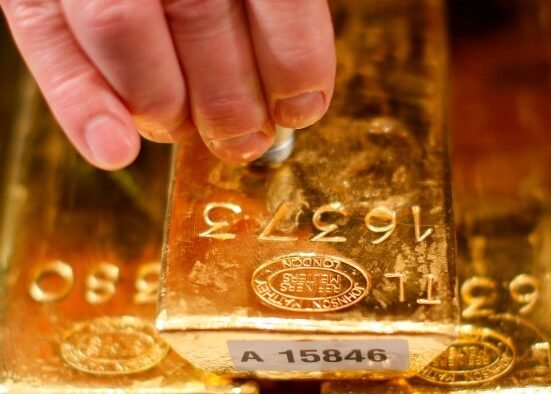

Gold prices in India edged lower on Monday, with 24-carat gold (99.9% purity) falling by Rs 160 to Rs 99,800 per 10 grams in the national capital, according to the All India Sarafa Association. | Image:

Freepik

Gold Price Today: Gold prices in India edged lower on Monday, with 24-carat gold (99.9% purity) falling by Rs 160 to Rs 99,800 per 10 grams in the national capital, according to the All India Sarafa Association.

On Friday, it had closed at Rs 99,960 per 10 grams. Meanwhile, 99.5% purity gold dropped by Rs 150 to Rs 99,100 per 10 grams.

Despite the fall in gold prices, silver remained steady at Rs 1,05,200 per kilogram. Globally, spot gold was slightly down, trading at $3,365.40 an ounce.

Even with the small correction in prices, experts believe it may be a good time for investors to begin accumulating gold, but with caution.

Gold Price Target

Dr. Renisha Chainani, Head of Research at Augmont, suggests that the current geopolitical tensions between Iran and Israel, along with inflation concerns and possible US Fed rate cuts, make a strong case for gold in the long run.

“Yes, investors can start investing in gold, especially now, as an ongoing Iran-Israel conflict has increased geopolitical uncertainty. Gold typically performs well during crises, given its safe-haven status,” she said.

However, Chainani advises against putting in a lump sum at the current high levels. “I would prefer a staggered approach or SIP in gold exchange-traded funds or digital gold. A staggered method helps to mitigate risk, and if there are any short-term corrections and weaknesses in the face of global volatility, the staggered approach helps to average out the cost,” she added.

Global Uncertainty

Adding to the global uncertainty, the US bombing of Iran’s nuclear sites has further complicated the outlook for inflation and economic growth just ahead of a busy week packed with key economic data and central bank commentary. US Federal Reserve Chair Jerome Powell is also set to testify before Congress over two days.

Last week, the Fed kept interest rates unchanged but signalled fewer cuts this year due to economic concerns. Investors are now expecting around 50 basis points worth of rate cuts by year-end. Since gold usually benefits in low interest rate environments and times of uncertainty, the current situation could support prices in the near term.

In other metals, spot silver rose 0.3% to $36.12, platinum climbed 2.1% to $1,292.03, and palladium advanced 2.7% to $1,072.42.