Pull-Ahead New Vehicle Sales Rate Slows, Used and Certified Used Vehicle Prices Rise

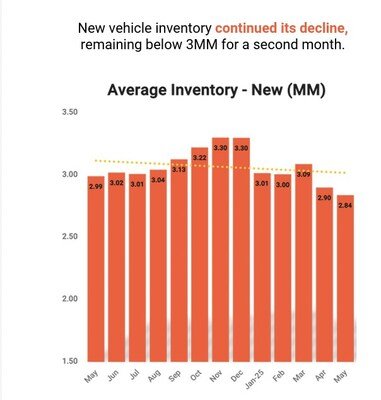

GRAND RAPIDS, Mich., June 5, 2025 /PRNewswire/ — New-vehicle inventory fell to 2.84 million units in May, the lowest inventory level since February 2024. Meanwhile, the average marketed price for new vehicles jumped by $200 from late April to late May, according to ZeroSum’s June 2025 “State of the Dealer” report.

Average marketed prices for both Used and Certified Used vehicles rose as well. Used jumped by $800 to $26,400 month-over-month, while Certified rose by $1,030 to $38,000 when comparing April 30 to May 31. Used and Certified Used vehicles remain well below New vehicle prices and will play a crucial role in dealership profitability, as tariffs will likely raise New vehicle prices over the next several months.

“The Used vehicle sector is continuing to benefit from the turbulence in the New vehicle marketplace,” said Josh Stoll, Vice President of Dealer Success at ZeroSum. “And with many of the OEMs ending their pricing programs and New prices starting to go up, Used vehicles will become an even more important safe haven for buyers. Dealers should take a very close look at their inventory positions and pricing strategies compared to their competitors to maximize their sales and the profitability of these vehicles.”

Auto dealers continue to see strong pull-ahead sales, as many shoppers are making vehicle purchases in anticipation of looming tariff-driven new vehicle price increases. To date, an estimated 460,000 sales since Feb. 24 have been pull-ahead. The rate of pull-ahead sales is slowing, however, with an estimated 120,000 units in May compared to an average of 170,000 units in March and April.

Discounts and incentives being marketed to consumers averaged $2,065 over the month of May, up from $1,891 in April. At the end of the month, however, average promoted retail discounts and incentives were $265 less aggressive than the last day of April—another indication that pricing is beginning to move up as OEM discount programs come to an end.

“May was a bit of a wait-and-see month in terms of New vehicle results. Consumers were still buying at an elevated pace, though not to the extent that we saw in March and April,” Stoll said. “Meanwhile, price hikes took a bit of a pause as OEMs continued with discount programs ahead of tariff effects on incoming inventory. With some of those programs ending, tariffs will likely drive pricing increases going forward.“

ZeroSum provides cutting-edge inventory-based market intelligence and digital advertising solutions tailored to dealers. The State of the Dealer report is the first and premier data source for the new, used, and certified pre-owned automotive markets.