Illumina is suing Element Biosciences, with the sequencing giant accusing its smaller rival of infringing on five of its patents covering flow cell and imaging technologies used in automated genetic sequencing, and Element vowing to defend itself in court.

In a complaint filed Thursday in U.S. District Court for the District of Delaware, Illumina and its U.K. subsidiary, Illumina Cambridge, accused Element of infringing on patients assigned to the company.

“Element seeks to use and profit from Illumina’s innovations without compensating Illumina for its tremendous investment in research and development over many decades to create its groundbreaking genetic sequencing instruments,” Illumina stated in its complaint. “Illumina brings this action to hold Element accountable for its sale of systems claimed by the Patents-in-Suit and to end its infringement.”

Element is responding to the lawsuit with a 23-word statement emailed to GEN Edge and other news outlets: “Element is proud of its strong history of innovation. We are reviewing the complaint and look forward to defending our innovations in court.”

The case number for Illumina’s lawsuit is 1:25-cv-00602.

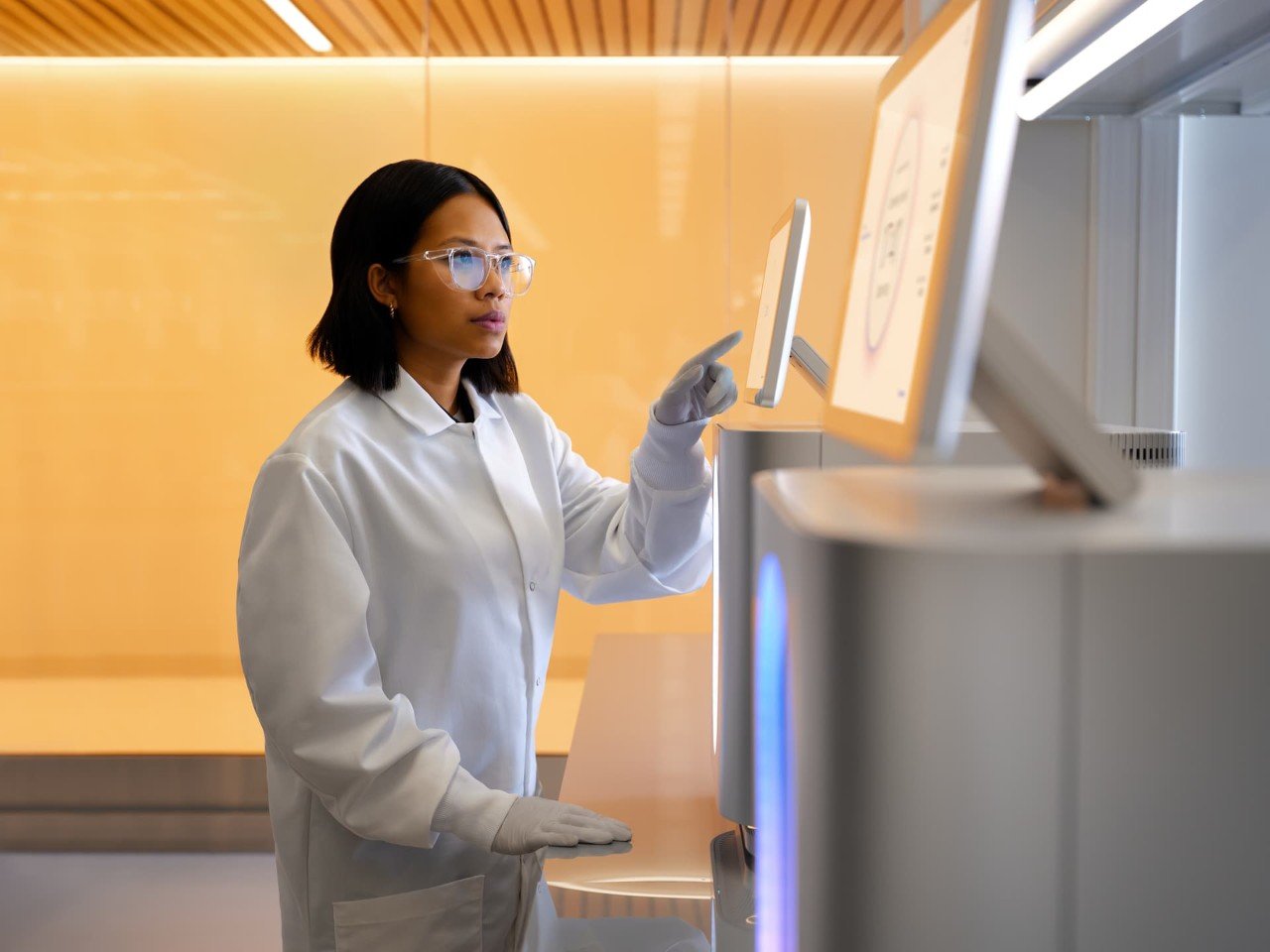

In the suit, Illumina said the patents cover inventions applied by the company in its MiSeq and MiniSeq instruments. MiSeq—launched in 2011 with an updated series, the MiSeq i100, introduced last year—is designed to let users finish sequencing runs in just eight hours from the first step of sample preparation to the completed result, including only twenty minutes of hands-on time.

MiSeq now can complete a sequencing run of 850 million base pairs in only 5 1/2 hours, or as many as 15 billion base pairs when using Illumina high-output consumables: “The combination of innovations protected by the Patents-in-Suit made the MiSeq a hugely successful instrument that could perform lab-scale sequencing runs faster and more cheaply than its predecessors.”

MiniSeq, launched in 2016, can sequence up to two billion base pairs in five hours, not including the time to prepare the sample library. MiniSeq is designed for “load and go” use, minimizing manual preparation, errors, and inconsistencies in sequencing.

“Illumina has made it easier to sequence genetic material without the supervision of highly trained lab technicians. This achievement allows laboratories to sequence more samples at a lower price and has expanded the types of institutions that can perform sequencing,” Illumina stated in its court complaint.

Illumina has asked the District Court for a judgement in its favor, an injunction against infringement of its patents, attorney’s fees, and unspecified “damages adequate to compensate Illumina for the infringement, but in no event less than a reasonable royalty for the use made of the inventions by Element, together with interest and costs.”

Five patents at issue

The patents Illumina alleges are infringed include U.S. Patent No. 12,251,702, issued March 18 and titled, “Flowcell cartridge with floating seal bracket,” as well as four patents, all titled, “Systems, methods, and apparatuses to image a sample for biological or chemical analysis.”

“A cartridge for use with chemical or biological analysis systems, as well as methods of using the same, is provided,” according to the cartridge patent’s description of the invention covered. “The cartridge may include a floating microfluidic plate that is held in the cartridge using one or more floating support brackets that incorporate gaskets that may seal against fluidic ports on the microfluidic plate.”

Why a cartridge approach to the flow cell?

“Since it is difficult to decontaminate a flow cell after a sample has been flowed through it, it is common to replace the flow cell before analyzing a particular sample,” the patent explained. “As such, it is common for flow cells to be implemented using a cartridge-based approach to facilitate easy replacement of the flow cells.”

The four patents cover systems, methods, and apparatuses, including a fluidic device holder configured to orient a fluidic device:

- U.S. Patent No. 8,951,781, dated February 10, 2015

- U.S. Patent No. 11,117,130, dated September 14, 2021

- U.S. Patent No. 11,697,116, dated July 11, 2023

- U.S. Patent No. 12,151,241, dated November 26, 2024

“Embodiments of the present invention relate generally to biological or chemical analysis and more particularly, to assay systems having fluidic devices, optical assemblies, and/or other apparatuses that may be used in detecting desired reactions in a sample,” the four patents stated.

Examples of such protocols, the patents explained, include DNA sequencing, specifically sequencing-by-synthesis (SBS).

“Systems configured to perform such protocols may have limited capabilities and may not be cost-effective. Thus, there is a general need for improved systems, methods, and apparatuses that are capable of performing or being used during assay protocols, such as the SBS protocol described above, in a cost-effective, simpler, or otherwise improved manner,” according to the four patents.

“Best of NGS”

Illumina and privately held Element are among companies listed by GEN in its recently updated A-List, “The Best of NGS,” consisting of separate listings of sequencing instrument providers, Sanger sequencing-based instrument companies, and providers of sequencing offerings consisting primarily of workflow solutions.

In its lawsuit, Illumina emphasized that Element was founded in 2017 by several former Illumina employees who had helped develop its next-generation sequencing (NGS) technology. Element’s founder and CEO, Molly He, was Illumina’s former senior director of scientific research; while Mike Previte, Element’s CTO, formerly served as Illumina’s associate principal scientist; and Matt Kellinger, Element’s head of biochemistry, is a former Illumina staff scientist.

Element has emerged as a successful competitor to Illumina, having disclosed an estimated 2024 revenue of approximately $60 million in January at the 43rd Annual J.P. Morgan Healthcare Conference—more than double the “more than $25 million” in 2023 revenue reported by the company a year earlier at the same conference.

Last year, Element completed a $277 million Series D financing, bringing its total capital raised to more than $680 million.

Element has used the financing to further commercialize its AVITI™ benchtop DNA sequencer, and advance its top-tier AVITI24™ system, launched last year with the aim of enabling simultaneous examination of DNA, RNA, proteins, phosphoproteins, and cell structure within single cells.

This year Element is rolling out upgrades or “Innovation Roadmap” for AVITI24, with the company expecting during the second half of 2025 to introduce to market direct in-sample sequencing for a wide range of new use cases, including completely library-prep free, unbiased whole transcriptome, and targeted RNA sequencing.

“Element’s AVITI sequencers are highly similar to Illumina’s sequencing instruments and practice every limitation of the asserted claims of the Patents-in-Suit,” Illumina contended.

Illumina’s patent lawsuit likely relates to its perception that Element has become a successful competitor, Albert Vilella observed Friday in his Substack publication Rhymes with Haystack, which covers spatial biology and other biotech technologies.

“The fact that Illumina has chosen to start this legal battle now is probably a reflection of the fact that they see Element Bio as a real threat to their business, even though it’s still early days for Element and the company has not even IPO’ed yet,” Vilella wrote, using the abbreviation for initial public offering.

Alex Dickinson, co-founder and chairman of Ryght, developer of an enterprise-grade generative artificial intelligence (AI) platform for life sciences, offered a similar observation on LinkedIn: “Classic strategy, wait until they have significant units in the field and significant revenue to attack.”

“Careful consideration”

In a statement, Illumina insisted its lawsuit against Element reflected more a desire to protect its IP rather than its longtime leadership in the NGS market, where it has dominated against competitors for about two decades.

“We file lawsuits only after careful consideration and when we have evidence of infringement. While we welcome fair competition, it’s only fair if intellectual property laws are respected,” Illumina stated. “Legal protections for intellectual property provide incentives for innovation, which is good for customers, patients, and global health.”

Illumina spent $1.169 billion on R&D last year, according to consolidated results that included operations of Grail, the cancer blood test developer that Illumina spun off in June 2024. Illumina contracted that with the $167 million it spent on R&D in 2011, the year it launched MiSeq.

“Illumina invests significantly in research and development for our sequencing technology and obtains intellectual property to protect innovations resulting from these investments,” the company further stated.

Illumina filed the lawsuit to prevent the unfair use of its technology by Element,” Illumina stated Friday through a spokesperson. “We file lawsuits only after careful consideration and when we have evidence of infringement.”

Illumina’s statement offered no response to a GEN question: What, if any, concern does the company have about a litigation risk, namely, invoking the wrath of current or potential academic customers, as 10x Genomics did by pursuing patent infringement lawsuits against competitors. This week, 10x and Bruker announced that they settled their litigation, weeks after 10x and Vizgen settled their legal dispute.

“Always a risk”

“Going to court is always a risk, as Illumina realized when they battled with MGI Tech/Complete Genomics, and came out of that battle licking their wounds and being close to half a billion dollars worse from that battle,” Vilella posted Friday on BlueSky.

Illumina in July 2022 settled litigation with BGI Group’s sequencing instruments affiliate MGI Tech and its U.S. subsidiary Complete Genomics (GCI), with Illumina agreeing to pay $325 million to end the U.S. lawsuits. At the time, Illumina disclosed in a regulatory filing that it received from BGI a fully paid-up license to six patents and five patent applications covering Illumina’s “2-channel” sequencing technology to prepare DNA fragments for sequencing with no additional royalties owed, while Illumina gave BGI a fully paid-up license to three “image mix” patents plus related patent applications.

The settlement came two months after a jury in Delaware awarded Complete Genomics approximately $334 million after concluding that its patent rights had been infringed by Illumina through the 2-channel technology. In December 2021, a U.S. District Court jury in San Francisco awarded Illumina $8 million after finding BGI willfully infringed upon four Illumina patents focused on its proprietary azido sequencing-by-synthesis chemistry—but the jury also invalidated a separate Illumina patent (No. 7,541,444, “Modified nucleotides”) and the first claim of another (No. 10,480,025, titled “Labelled nucleotides”).

Villela said Element also faces the possibility that Illumina may prevail on its lawsuit by persuading a judge or jury that Element is heavily staffed by Illumina ex-employees: “If there is the perception that the fact that Element has many Illumina ex-employees is reason enough to uphold Illumina’s patents and ban Element Bio from selling AVITI instruments, then Illumina might win this battle.”

Illumina highlighted that potential argument in its court complaint, stating that Element “was formed by a group of former Illumina employees in 2017 to sell genetic sequencing systems that borrow heavily from Illumina’s systems, including technologies that were developed while those Element employees were working at Illumina.”

“Today, Element’s sequencing instruments and consumables compete directly with Illumina’s products,” Illumina stated.