Stock image.

The dominant gold-miners ETF’s catch-up rally with gold is really accelerating. Traders are increasingly flocking back to gold stocks as their metal soars deeper into the psychologically-huge $3,000s. Despite their mounting gains, gold stocks remain seriously undervalued relative to their metal. They still need to mean revert massively higher to reflect their epic fundamentals with these lofty prevailing gold prices.

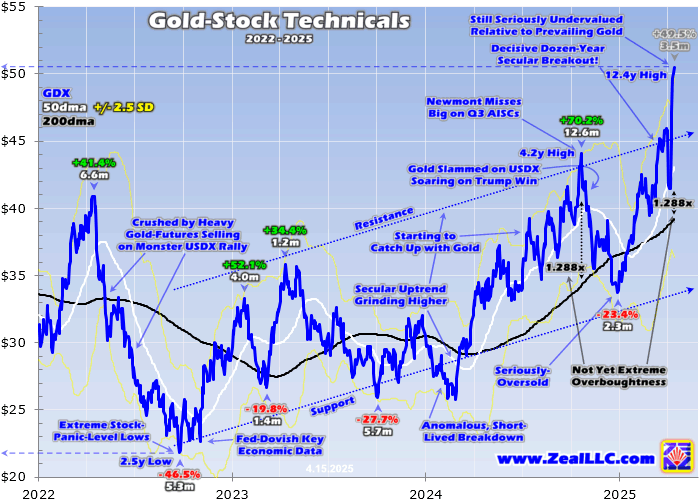

The GDX major-gold-miners ETF skyrocketed 19.8% in three trading days ending last Friday! That catapulted GDX to a $49.70 close, a dazzling 12.4-year secular high. The gold stocks continued rallying this week, with GDX hitting $50.50 Tuesday and running $52.50 Wednesday morning as I pen this essay. These are the best levels the major gold stocks have seen since November 2012, pretty much an eternity ago.

With gold stocks finally getting hot again, bullish financial-media coverage is growing. This long-ignored contrarian sector is popping up on more traders’ radars, attracting bigger capital inflows. The higher gold stocks rally, the more traders want to pile in and chase their big gains. While GDX’s pursuit of gold has quickened, it is far from over. Gold-stock prices still need to power way higher to normalize with their metal.

Stock prices ultimately gravitate to some reasonable multiple of their underlying corporate earnings. For gold miners, those can be approximated quarterly. Subtracting their average all-in sustaining costs from the average gold price yields a great proxy for sector profitability. While gold miners will report their latest Q1’25 results over this coming month, the previous Q4’24’s remain the last fully-reported ones to analyze.

That quarter gold averaged a record $2,661 on close, while the GDX-top-25 gold miners’ AISCs averaged $1,454 per ounce. That made for implied unit profits of $1,207 per ounce, record levels soaring 77.5% YoY! GDX averaged $38.36 in Q4, languishing especially into its end. Gold stocks slumping out of favor made no sense fundamentally. Their latest bull run was born with gold’s monster upleg back in October 2023.

That was early in Q4’23, where gold averaged $1,976 and the GDX-top-25 AISCs averaged $1,296. That implied the major gold miners were earning $680 per ounce. Over the next four quarters, average gold prices surged 34.7% which GDX per-ounce earnings leveraged rocketing 77.5%. Gold-stock prices should’ve roughly paced their underlying profits growth, yet GDX’s quarterly-average prices merely climbed 31.1%.

Gold stocks have really lagged gold, despite its remarkable 2024. Last year the ancient metal of kings soared 27.2%, besting even the mighty S&P 500’s 23.3% gains! Yet astoundingly GDX merely climbed 9.4% in 2024, for dismal 0.3x upside leverage to gold. Historically the major gold stocks dominating GDX have tended to amplify material gold moves by 2x to 3x. There are many examples of this in recent years.

Gold’s current monster upleg has ballooned to epic 77.8% gains over 18.2 months without a single 10%+ correction! This is among gold’s biggest uplegs in decades, the first to achieve 40%+ monster status since a pair both cresting in 2020. Those averaged 41.4% gains, which GDX leveraged by 2.5x to nice 105.4% average gains! Yet during gold’s current upleg, GDX has only climbed 91.8% for poor 1.2x leverage.

If gold stocks were functioning normally over this past year-and-a-half, GDX would’ve already soared 156% to 233% leveraging gold its usual 2x to 3x! If gold stocks can’t well-outperform their metal, they aren’t worth owning. The gold miners heap big additional operational, geological, and geopolitical risks on top of gold price trends. If investors aren’t compensated for those, they are better off owning gold itself.

Thankfully as gold stocks return to favor, their upside leverage to gold is recovering. Year-to-date as of Tuesday’s close, GDX has soared 48.9% amplifying gold’s 23.1% gain by 2.1x. With gold-stock interest surging back, their long-overdue massive mean-reversion catch-up rally with gold is finally underway. My first essay of 2025 in early January predicted this year would prove gold stocks’ revaluation year.

Their chronic undervaluations reflecting traders’ lack of interest are a huge unsustainable anomaly. Again GDX recently broke out to dozen-year highs, which I forecast was imminent in a late-February essay. The last time major-gold-stock prices had been at recent GDX levels was way back in Q4’12. Then gold averaged $1,718 on close, and according to the World Gold Council this sector’s AISCs ran about $1,025.

That implied unit profits around $693, which were big then. Fast-forward to Q1’25, when GDX finally regained those price levels. Gold averaged a record $2,866 last quarter, and based on their guidances the GDX-top-25 gold miners’ AISCs will likely average around $1,500 per ounce. That implies record unit earnings near $1,366, 97.1% higher than a dozen-plus years ago! So gold stocks should be at least twice as high.

Yet all those long years ago in Q4’12 GDX averaged $49.15, which dumbfoundingly was 21.6% higher than Q1’25’s $40.43 average! Underlying earnings double over a long secular span yet stock prices grind considerably lower? That sure doesn’t jibe fundamentally. This madness can’t and won’t last, gold-stock prices need to mean revert far higher to reflect fat underlying earnings at these record prevailing gold prices.

Huge profits growth is nothing new for the major gold miners. Over the last six reported quarters ending in Q4’24, the GDX-top-25’s implied unit profits have soared 87%, 47%, 35%, 84%, 74%, and 78% YoY! And Q1’25’s are conservatively tracking for another 72%-YoY jump. There’s no other sector in all the stock markets anywhere near rivaling this fantastic sustained earnings growth, which investors will figure out.

While gold stocks have really lagged their metal, they still have been following it higher on balance in recent years. This GDX-technicals chart shows gold stocks’ uptrend, which was just shattered to the upside by GDX’s 20% jump over just a few trading days! GDX’s gold pursuit is quickening, which should increasingly feed on itself. The faster and higher gold stocks rally, the more traders want to chase their gains.

While that latest gold-stock surge was impressive and eye-catching, it remained pretty small in a longer-term context. GDX has blasted up 49.5% in 3.5 months since its latest interim low in late December, for lower 2.1x upside leverage to gold. When gold surges like this, gold-stock uplegs tend to rally faster and grow larger. In mid-2020 for example, GDX soared 134.1% in 4.8 months on an underlying 40.0% gold upleg!

That 3.4x upside leverage to gold was better than anything seen since. But mid-2020 was also the last time gold stocks had really returned to favor. When more-mainstream speculators and investors start chasing them along with the usual contrarians, they way-outperform their underlying metal. Because this sector is small compared to broader stock markets, relatively-small capital inflows catapult gold stocks far higher.

After every quarterly earnings season, I dig into the GDX top 25’s results and write an essay analyzing them. The last time that happened was in mid-March. With GDX trading near $42 then, the total market capitalizations of its top 25 components ran $397b. That is skewed high too, because some of them only trade in foreign stock markets. That same day, the S&P 500 stocks’ collective market cap was $50,408b.

So the biggest gold majors dominating GDX were only worth about 0.8% of the broader stock markets, practically a rounding error! Exclude the world’s largest gold miner and top GDX component Newmont which is the only gold miner in the S&P 500, and GDX-top-25 foreign gold stocks not traded in the US, and that ratio shrinks to just 0.5%. So gold stocks fly if even a tiny fraction of stock investors chase them.

It’s debatable what a reasonable portfolio allocation to gold stocks should be, as this sector is very volatile and risky. But for many centuries if not millennia, 5%-to-10% gold allocations were universally seen as essential for all investors. Another 5% to 10% added on top of that in gold stocks would greatly boost gold’s diversification value, mainly moving counter to stock markets when they weaken lifting gold stocks.

We’ve sure seen this in spades recently. Over the last couple weeks or so, the S&P 500 has fallen 4.8% on global-trade-war fears as big tariffs ramp. And that masks some near-record volatility within that span. Yet while stock-market fear skyrocketed to extremes, gold rallied 3.6% which GDX amplified an excellent 2.9x to a 10.4% gain! Gold and its miners’ stocks greatly improve portfolio returns during stock-market selloffs.

While holding GDX is acceptable for a gold-stock allocation, it certainly isn’t optimal. The super-major and large major gold miners dominating GDX have long struggled with production growth. They haven’t been able to consistently overcome depletion, and their huge corporate overhead often leads to higher mining costs and thus lower profitability. This deadweight hobbles over a third of GDX’s total weightings.

Smaller mid-tier and junior gold miners have long outperformed their larger peers. Operating at smaller scales, they have been better able to consistently grow their production often at lower mining costs. Their market capitalizations are also much lower than larger miners’, making their stocks easier to bid higher on capital inflows. The GDXJ mid-tier gold-stock ETF cutting out super-majors and large majors is way superior.

But even that pales in comparison to experienced stock-picking, which I’ve specialized in for a quarter-century now. Studying this sector to find the best fundamentally-superior smaller gold miners, then adding trades in them when gold stocks are relatively-low, is the ideal way to prudently diversify into gold stocks. Our acclaimed weekly and monthly subscription newsletters trade better gold miners as warranted.

Again last year GDX dreadfully underperformed, only rallying 9.4%. Yet in 2024 we realized 84 mostly-gold-stock trades in our newsletters, which averaged outstanding +43.1% annualized gains! Regardless of what GDX is doing, smaller-gold-stock trades carefully selected and timed will fare way better. And that outperformance will continue growing as more speculators and investors figure this out and start chasing.

Back to GDX which remains gold stocks’ leading benchmark, even these $50+ levels are nowhere near record highs. While gold has achieved an astonishing 65 nominal record closes so far in this monster upleg, GDX has clocked in at zero. Gold stocks as a sector won’t forge into record territory until GDX bests $66.63, its record high seen ages ago in early September 2011! Gold stocks have a long way to run yet.

No one has any idea how high they could ultimately fly, but it’s a heck of a lot higher from here. Given their massive record profits with colossal sustained high-double-digits growth, gold stocks are seriously undervalued. Plenty are still trading at dirt-cheap trailing-twelve-month price-to-earnings ratios in the teens or even single-digits! This extreme anomaly has to be resolved by a massive mean-reversion rally.

While the sky’s the limit for long-term targets, shorter-term ones are easier to predict. Again historically GDX has tended to amplify material gold moves by 2x to 3x. Gold’s current monster upleg has soared 77.8% at best as of midweek, implying GDX’s parallel bull run needs to extend to 156% to 233% gains. From October 2023’s lows, that works out to GDX soaring somewhere between $66 to $86 in coming months!

That lower end is right on the verge of new-record territory, and when GDX achieves new all-time highs gold-stock enthusiasm will really intensify. At the rate gold stocks are surging, that could happen fairly soon. This current spring-rally timeframe is when gold stocks usually enjoy their best seasonal outperformance of gold during the year. Strong seasonals are nice tailwinds blowing behind record fundamentals.

Gold itself has great prospects too, increasingly becoming the global trade-war refuge. Stock markets around the world are selling off on big tariffs likely forcing corporate earnings lower. US Treasuries and the US Dollar have fallen too, as foreign countries need much less of both if trade is going to shrink. Gold is really shining in this extreme uncertainty, and American stock investors have only just started chasing it.

The bottom line is GDX’s gold pursuit is quickening. After lagging their metal for long years, the gold stocks are increasingly starting to catch up. With these high prevailing gold prices fueling record profits, gold stocks still have massive mean-reversion rallying to do to reflect their epic fundamentals. Miners’ earnings are not only huge, but have been growing way faster than any other sector’s for many quarters now.

After long overlooking gold stocks, traders are increasingly starting to return. Their capital inflows are accelerating upside momentum in this small sector, boosting awareness and interest. The higher gold stocks climb, the more traders will want to chase their upside quickening their gains. With gold stocks still seriously undervalued, allocations can still be added with earlier buying improving potential for bigger gains.

(By Adam Hamilton)