Donald Trump’s Treasury Secretary brushed off concerns about the crashing stock market that wiped trillions of people’s 401(K)s on Sunday.

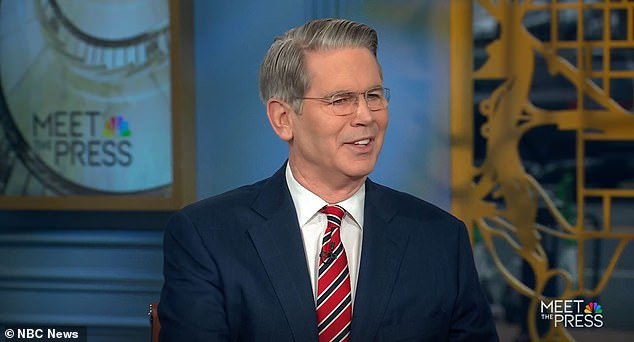

Treasury Secretary Scott Bessent, a former hedge fund manager, dismissed concerns about a looming recession – and revealed his plans to ease the current economic tensions and halt what appears to be an inevitable financial crash.

The president has ramped up a trade war that caused the 7th fastest stock market slump on record on Thursday, dragging the S&P 500 more than 10 percent below its record

A 10 percent drop is a big enough deal that professional investors have a name for it – a ‘correction’ – and the S&P 500’s 1.4 percent slide on Thursday sent the index to its first since 2023.

‘I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal,’ Bessent said on NBC’s ‘Meet the Press.’

‘What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis. It would have been much healthier if someone had put the brakes on in ’06, ’07. We wouldn’t have had the problems in ’08.’

Bessent boasted about Trump’s economic plans claiming they will stop any potential financial crisis.

‘What I could guarantee is we would have had a financial crisis. I’ve studied it, I’ve taught it, and if we had kept up at these spending levels that – everything was unsustainable,’ he said.

Treasury Secretary Scott Bessent, a former hedge fund manager, dismissed concerns about a looming recession on Sunday

Bessent boasted about Trump’s economic plans claiming they will stop any potential financial crisis

‘We are resetting, and we are putting things on a sustainable path. We are putting the policies in place that will make the affordability crisis go down, inflation moderate and as we set the sails I am confident that the American people will come our way.’

He brushed off concerns that the U.S. stock markets closed down sharply last week amid mounting uncertainties arising from Trump’s policies, including tariff threats against the biggest U.S. trading partners.

‘I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great,’ Bessent said. ‘I say that one week does not the market make.’

The stock market turbulence is a result of uncertainty about how much pain Trump will let the economy endure through tariffs and other policies in order to reshape the country and world as he wants.

The president has said he wants manufacturing jobs back in the United States, along with a smaller U.S. government workforce and other fundamental changes.

Trump’s latest escalation came Thursday when he threatened 200 percent tariffs on champagne and other European wines, unless the European Union rolls back a ‘nasty’ tariff announced on U.S. whiskey.

The European Union unveiled that move on Wednesday, in response to U.S. tariffs on European steel and aluminum.

The president has beefed up tariffs as part of his effort to reshape America’s trading partnership with the world, sparking a bitter trade war

The president has ramped up a trade war that caused the 7th fastest stock market slump on record on Thursday

The European Union launched retaliatory tariffs on Wednesday, in response to U.S. tariffs on European steel and aluminum

U.S. households and businesses have already reported drops in confidence because of all the uncertainty about which tariffs will stick from Trump´s barrage of on -again, off -again announcements.

That´s raised fears about a pullback in spending that could sap energy from the economy. Some U.S. businesses say they´ve already begun to see a change in their customers´ behavior because of the uncertainty.

A particularly feared scenario for the economy is one where its growth stagnates but inflation stays high because of tariffs.