A fraudster who has run scams against Australians for more than two decades has resurfaced at the centre of a dispute over patents potentially worth more than $21 billion.

The patents cover a method of calculating surge pricing — the mechanism companies like Uber use to jack up fares when lots of passengers book at the same time.

If they are valid, it would give their owners the right to collect royalties from companies like the rideshare giant which use surge pricing algorithms.

The surge pricing patents were originally developed by Gold Coast company Allotz under its founder, Martin McConnachie, for use in the hotel industry.

Allotz founder Martin McConnachie.

(Supplied)

In order to sue other users of the algorithms, Allotz needs to regain control of the patents.

They are currently in the hands of a company registered in US secrecy haven Delaware, which the investors claim has connections to a man now known as Brayden Craig.

Craig, formerly known by names including Scott Campbell Fisher, Trent Scott Wallace Strong, Scott Williams and Bennet Brayden Richards, is a veteran fraudster.

Fraudster ‘disappears, changes his name’

Authorities around the globe have largely been unable to lay a glove on Craig for 25 years or stop him from operating a string of dubious financial businesses using a dizzying array of corporate vehicles.

The exception is Thai police, who arrested Fisher, as he was then known, in 2000 as part of a highly publicised raid of a boiler room scam.

A boiler room is a type of scam where victims are cold-called and sold dodgy shares in companies.

The Thai call centre where Craig worked was staffed by expats — mainly young Australian and English men — who called victims from office cubicles in an anonymous Bangkok office block.

Loading…

In 2004 a Thai court convicted him over the boiler room, which operated under names including Brinton Group, fining him a few thousand dollars and sparing him jail.

Since then, he has been involved in litigation financing group Centaur Litigation, which collapsed in 2014 owing investors $130m after it was accused of being a Ponzi scheme.

Centaur Litigation took money from investors in Australia and around South-East Asia, promising them big returns from investments in backing lawsuits around the world.

As Centaur Litigation was collapsing, Craig set up and ran “business introduction scheme” Blue Edge Capital back in Australia, under the nose of the Australian corporate regulator.

The group was not connected to a US company of the same name.

While the ABC caught him on camera in 2001, walking into a strip club called “Thigh Bar” on Bangkok party strip Patpong Rd, no media organisation has photographed him in the years since the Thai boiler room bust.

The most recent picture of him the ABC could obtain is a blurry passport photo under the name Scott Fisher dated 2010 that depicts a heavier-set man than the one seen at the Thigh Bar.

A photo from the passport of Scott Campbell Fisher. (Supplied)

Not even the experienced private detective hired by investors in Allotz, Ken Gamble of IFW Global, has been able to track him down — even though Craig has been on his radar since 2016.

“Every time the law catches up with him, he disappears, changes his name, and resurfaces with a new scam,”

Mr Gamble said.

“I have been tracking Mr Craig for many years and monitoring his name changes and his illegal investment schemes. He takes considerable steps to remain elusive from authorities.”

A spokesperson for the Australian Securities and Investments Commission said the regulator was “aware of Scott Williams, who has also operated under the alias Trent Scott Wallace Strong”.

However, ASIC hasn’t taken action against him because he usually lives overseas and largely operates through offshore entities.

Allotz sought investors in bid to pursue patent claim

Allotz was in a precarious financial position when it first came into contact with Brayden Craig in late 2019, documents filed with the Federal Court reveal.

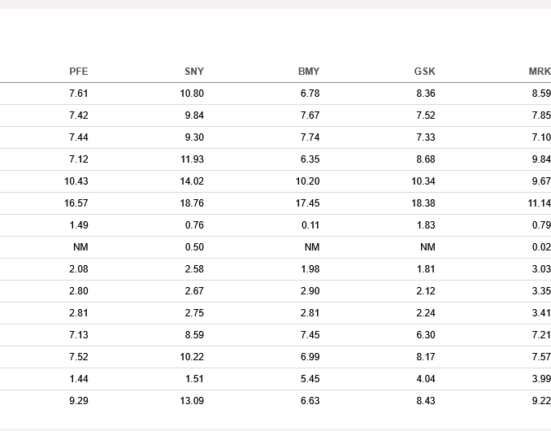

While a valuer hired by Allotz said its patents, originally developed to manage hotel bookings, could be worth between $US3 million and $US13.275 billion (between about $4.8 million and more than $21 billion), they had no value at all unless companies that use surge pricing methods, such as Uber, could be convinced to pay.

That meant taking expensive legal action against some of the biggest and best-resourced companies in the world.

However, Allotz was running out of cash to keep the lights on and the doors open — let alone finance a court case against the likes of Uber.

Company accounts filed with the court show that after losing $3.5 million in 2018-19, it had just $2,910 in the bank.

The accounts also reveal a potentially crushing dispute with the Tax Office, which claimed Allotz had wrongly claimed more than $550,000 in research and development benefits.

To help Allotz find investors, the company hired Queensland lawyer Grant McCartney in May 2019.

He introduced Allotz executives to Kirribilli Private Wealth, a group that described itself as “an alternative investment marketplace”.

Kirribilli was a UK-registered company where Brayden Craig was a director that claimed to be exempt from many UK and Australian laws regulating raising money from investors because it was a business introduction service — the same legal loophole previously exploited by Craig when he ran Blue Edge.

The Kirribilli operation involved a number of different corporate entities registered in various places around the world.

A corporate presentation, filed with the court, shows that the Kirribilli group also included Kirribilli Yield Market Place Limited, registered in tax haven the Seychelles Islands, First Degree Global Asset Management, registered in Singapore, Arris Venture Management, registered in Malaysia, and Kirribilli Assertion Management, whose place of registration wasn’t disclosed but whose staff were to be “employed by a Canary Islands domiciled entity”.

“Kiribilli Assertion Management Limited raises private capital in Australia, Africa, Europe, and Asia from Accredited Investors who have an appetite for tangible, alternative asset classes,” the group said in the document.

The money was to be invested in backing lawsuits — a similar business model to that touted by Craig’s previous group, Centaur Litigation.

Documents filed with the court show that in December 2019, Allotz executive Tom Taggart, a former federal cop, travelled to Thailand and met with several people involved with Kirribilli.

He also met Brayden Craig for two hours at the Soul building, a glitzy skyscraper that towers over the beach at Surfers Paradise on the Gold Coast.

Mr Taggart and Craig met at The Soul building on the Gold Coast. (Supplied: Tourism and Events Queensland)

“I attended this meeting to talk with Mr Craig about how he could provide a funding package to Allotz.com,” Mr Taggart said in an affidavit filed with the court.

Later, he compared the man he met to pictures of Scott Fisher published in newspaper articles about the Bangkok bust.

“Based on that meeting and the photos in the above newspaper articles, I believe that the man I know as Brayden Craig is Scott Campbell Fisher,” he said in his affidavit.

In late December, Allotz decided not to go ahead with taking money from Kirribilli, according to emails filed with the court.

“We have a far better offer on the table and that is the way we are going,” Allotz founder Martin McConnachie told Mr McCartney in an email sent four days before Christmas.

Patents transferred to US-based company

Allotz turned to a boutique Melbourne finance house for help raising desperately needed cash.

In January 2020, Allotz signed a deal where it agreed to pay it 8 per cent of whatever investment it brought in, documents filed with the court show.

Within three months the financiers had a deal in place. New investors it introduced would pump up to $8m in much-needed cash into Allotz.

In return, the investors received convertible notes, a type of financial instrument that pays interest but can be turned into shares later on.

By the end of the year, investors had tipped in $4.463 million, no doubt attracted by the interest rate on offer of 12.5 per cent.

Court documents and UK company records show that the bulk of the cash — $2.96 million — came from another UK company where Brayden Craig was a director. At the time, it had the confusingly similar name Allotz SPV, but was previously known as Kirribilli Litigation Finance.

However, Mr Taggart raised concerns over the bona fides of the Kirribilli operation in documents — an email to directors and a report to the Allotz board — obtained by the ABC.

In the email, sent on 15 June 2020, Mr Taggart said one person he met on his 2019 trip to Bangkok, “an Irishman who is based in Moscow and told me that he has a network of high net worth Russians” was listed on a website about financial rip-offs as “scammers involved in money laundering”.

“When I got to Bangkok and started talking to these people, I learned that there was no transparency for Allotz, as to what was actually happening between Kirribilli, their investment advisor network and their clients,” he said.

Mr Taggart said he was concerned by the business arrangements after meetings in Bangkok. (Supplied: Tourism Authority of Thailand)

He suggested “a deeper dive into the publicly available information” available about a list of people he met on the trip.

Mr Taggart made similar points in his report to the Allotz board ahead of a meeting on June 19, 2020.

“We have all heard about money laundering and it can take many forms, it is serious, it is global and is now being tied in with terrorism and being investigated vigorously by international law enforcement agencies, so it might be wise to be mindful of this potential when dealing with Allotz.com SPV Limited,” he said in the report.

The following year, the relationship between the finance house and the original Allotz crew broke down.

In the wash-up, the finance group obtained control of the patents — something it said it was entitled to do under its agreement with Allotz.

It rejected an offer from Mr McConnachie and Mr Taggart to buy them for $1.45 million and instead transferred them on to a company in the US state of Delaware in late 2021.

The Delaware company, Surge Pricing Patent Holdings or SPPH, was set up to hold the patents on behalf of the investors in the convertible notes, court documents show.

By January 2022, Allotz SPV had changed its name to Pinnacle Multi Series SPV and disappeared from the list of convertible note holders, court documents and company records show.

Instead, the biggest convertible note holder at the time was another Delaware entity, a trust called Peninsula Accelerator Trust, which held $3.31 million of the $4.63 million worth of notes on issue, according to court documents.

Completing the circle, a court has heard that Mr Craig is an advisor to Peninsula Accelerator Trust, which appointed one of SPPH’s two directors.

In his affidavit, Mr Taggart said the only person he has located as connected to Peninsula appeared to be a man who organised investment meetings in Thailand on behalf of Kirribilli back in late 2019.

Courts in Australia and US to decide patent’s fate

Who exactly put up the money that flowed through Kirribilli and into the convertible notes remains a mystery.

Some people who dealt with Brayden Craig never met him face-to-face.

Others, who did meet him, weren’t aware he was also Scott Fisher.

Loading…

Mr Craig was “a very large chap”, about 188 centimetres tall, with dark hair, one business figure who met with him has told a court.

“He was wearing a suit with a tie. He was well-groomed,” they said.

Mr McCartney told the ABC he worked for Allotz and Kirribilli was never his client.

He said that at the time he had no reason to have any concerns about Kirribilli being a money laundering scheme or boiler room operation.

“Brayden Craig was introduced to me by existing clients in early 2018 who were enjoying a very satisfactory relationship with Kirribilli,” he said.

He said he met Craig on “many occasions”.

“Initially with my clients who made the introduction dealing with their matters in 2018 and then in regard to the capital raise for Allotz, litigation funding for Allotz and work on verifying the Allotz patents.”

He said he had no direct knowledge of whether Brayden Craig and Scott Fisher were the same person but was aware of the allegations against him.

“Again, I have no knowledge of who he is,” he said.

“I knew him as Brayden Craig. He was good to deal with, he performed in terms of capital raising for my clients and for Allotz.“

An Australian court is set to decide whether or not Allotz owns the patents.

But whether they are worth billions — or nothing — stands to be decided by a different court, in the United States.

SPPH, now known as Surgetech, has already launched litigation in the US Federal Court system seeking to enforce the patents against Uber.

It’s lost the first round, with the case thrown out by a judge before it got to trial, but the case is currently on appeal.