UAE: The UAE’s Ministry of Finance (MoF) recently announced a new VAT law for the country’s precious metals sector, where businesses supplying such goods will no longer need to charge or collect VAT.

Meanwhile, the responsibility of calculating and declaring VAT will shift to buyers, according to a press release.

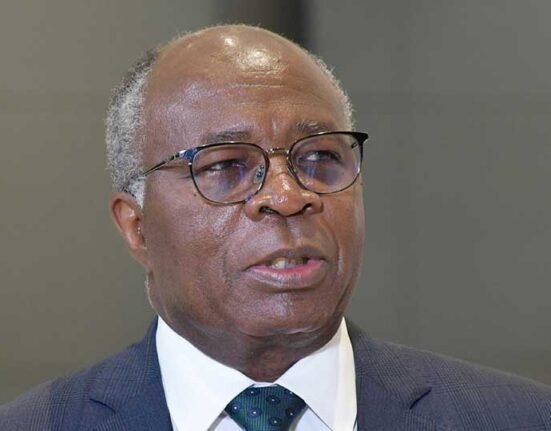

CEO and Asset Manager at DHF Capital, Bas Kooijman, breaks down the ramifications of this development for vendors and consumers, saying: “The new law enables businesses to streamline operations by reducing the potential for error and clearly outlining roles for all parties.”

Kooijman noted: “It simultaneously boosts investor confidence as buyers can avoid upfront VAT payments and lengthy wait times for refunds, offering more control and potentially improving their cash flow.”

The CEO concluded: “This is a significant step in the right direction as the UAE seeks to maintain its world-class position as a global trading hub for precious metals.”

Assets to See Higher Prices

While industry experts have largely predicted global commodity prices to fall in 2025, certain assets are forecasted to see higher prices.

Gold is a notable asset in this domain and will likely see an uptick in investment over the coming months after recording several all-time highs in 2024. This momentum could lead to gold trading at around $3,000 per troy ounce before the year’s end.

These projections align with the findings from a recently released DMCC report, which has positioned the UAE favourably.

The UAE surpassed the UK in 2023 to become the second-largest gold hub worldwide; the UAE’s stature as one of the most important hubs for gold training holds steady, and this trajectory is all but guaranteed to continue in the years ahead.

Kooijman commented: “Advising my clients to view compound interest as the ‘eighth wonder of the world,’ I’ve always been a proponent of diversifying one’s portfolio via multiple assets and gold remains a core component of this strategy.”

He added: “However, amidst the ongoing rise of AI and its various use cases in the industrial sector – such as the production of automobiles, solar panels, and even military applications – silver could also be a notable asset to invest in during upcoming months and is worth keeping an eye on.”

All Rights Reserved – Mubasher Info © 2005 – 2022 Provided by SyndiGate Media Inc. (Syndigate.info).