Sales of new houses jumped, fueled by lower prices, big incentives, and mortgage-rate buydowns. Homebuilders are taking share from homeowners.

By Wolf Richter for WOLF STREET.

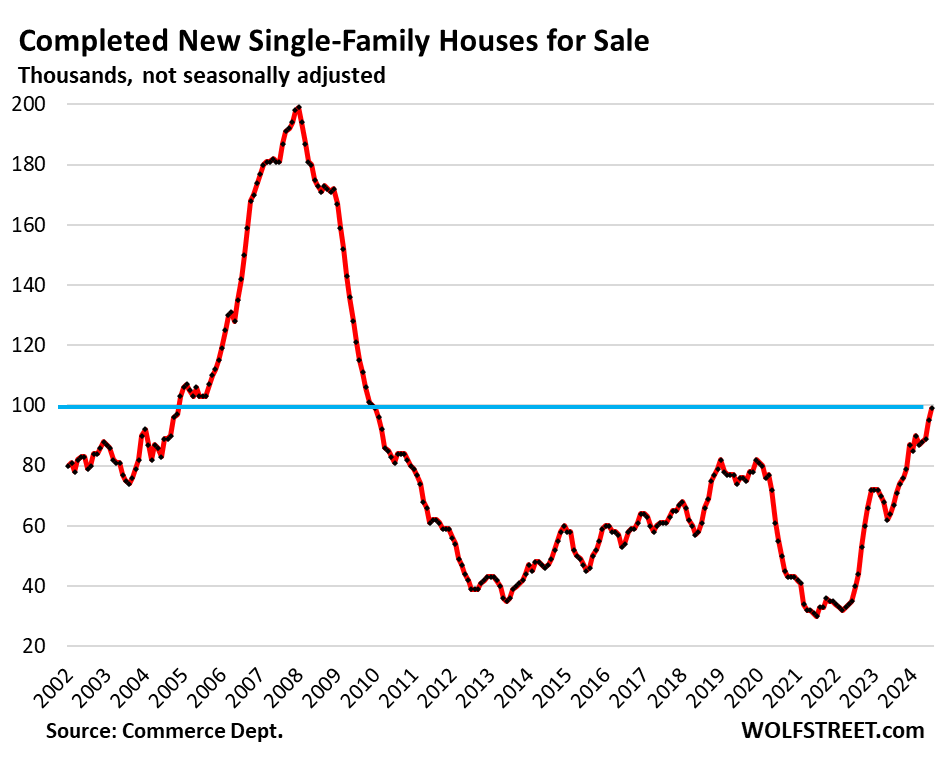

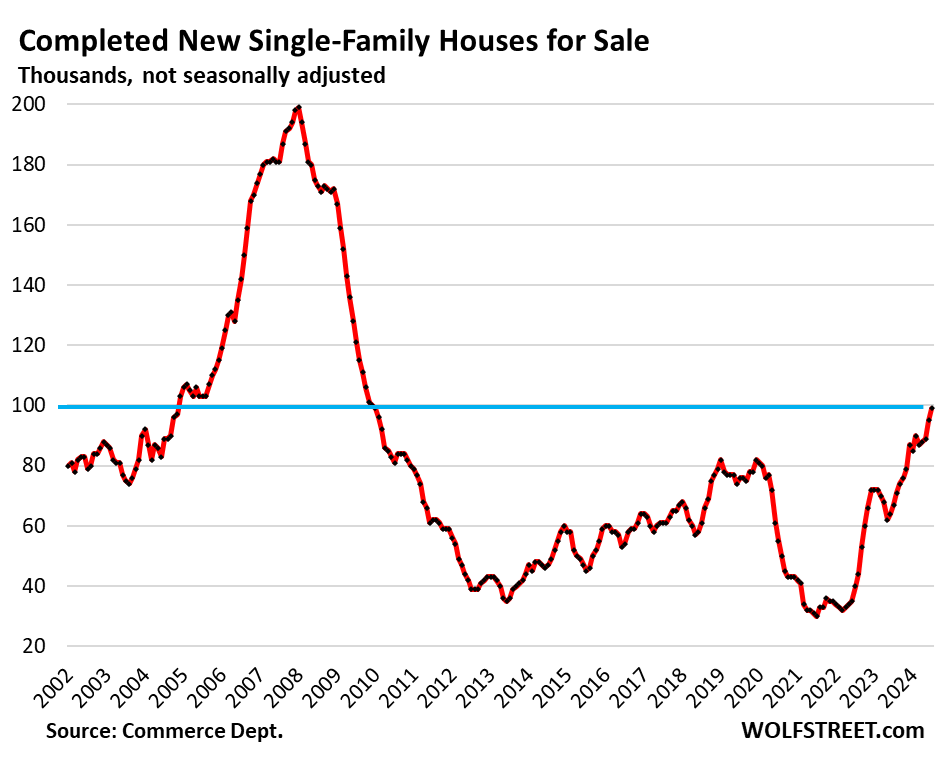

Inventory of new completed houses jumped to 99,000 houses in July, the highest since 2009, and about triple the inventory during the price-spike era of March 2021 through June 2022, according to Census Bureau data today.

Sales of completed houses jumped by 27% year-over-year to 28,000 houses. At this brisk rate of sales, the unsold inventory of completed houses translates into a healthy 3.5 months of supply.

These speculative houses are essentially move-in ready, they have to be sold quickly, builders have tied up lots of capital in them, and that inventory is encouraging builders to throw more incentives and mortgage-rate buydowns into the mix. This buildup of spec houses is exactly what the entire housing market needs the most to tamp down on prices.

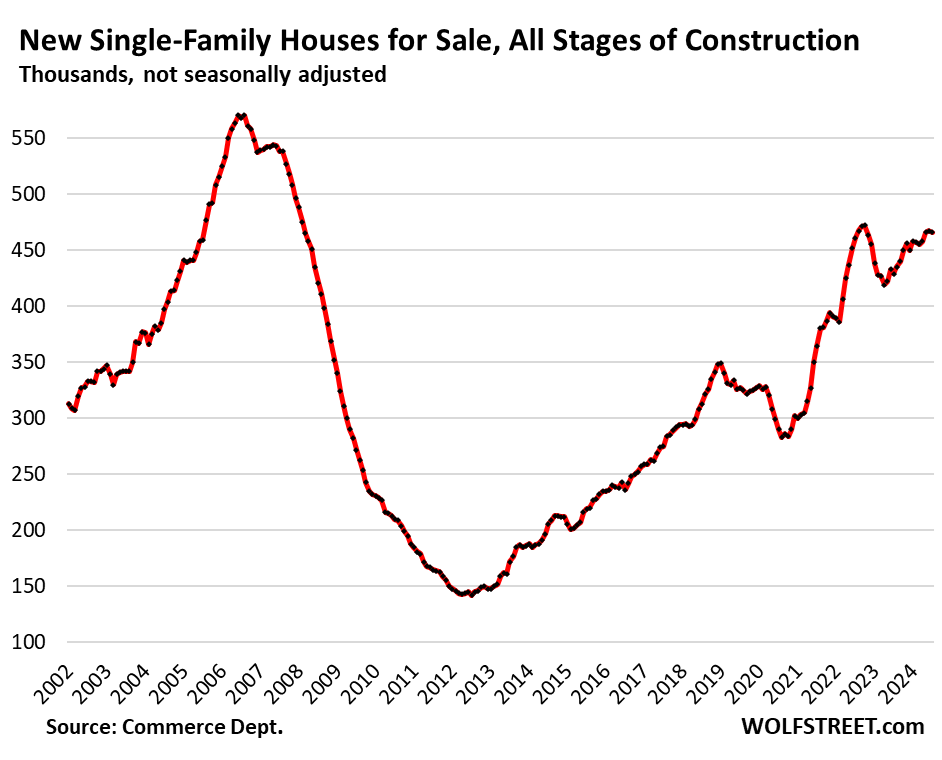

Inventories of houses in all stages of construction – from not yet started to completed – remained at about 466,000 houses for the third month in a row, along with August-October 2022 the highest since 2008. Supply, given the jump in sales in July, fell to 7.3 months.

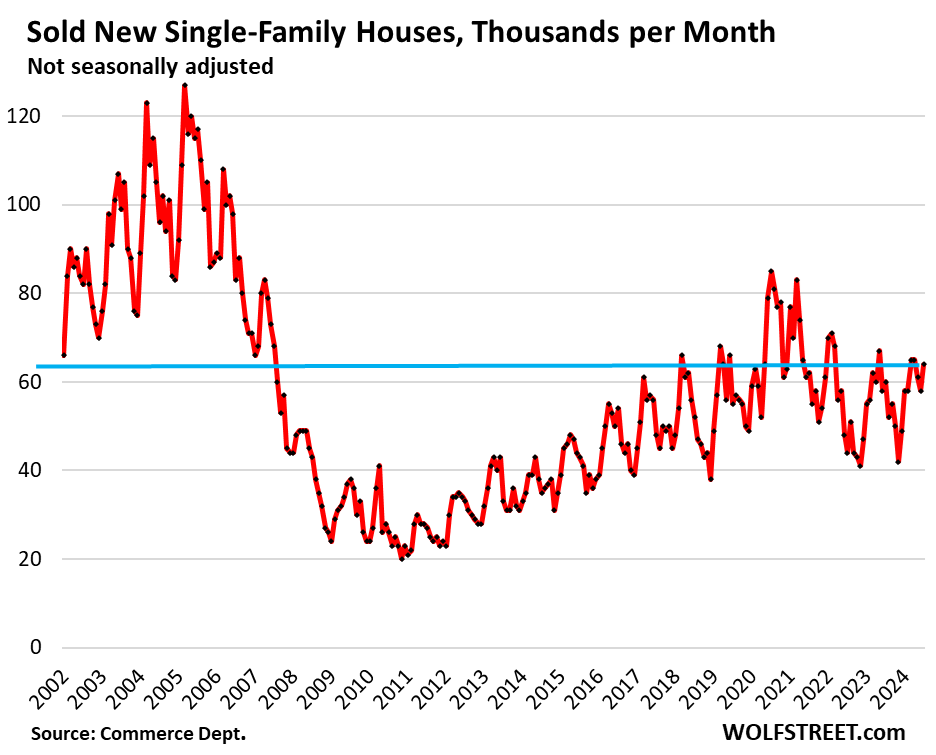

Homebuilders sold about 64,000 houses in July, not seasonally adjusted, up by 6.7% year-over-year and by 12% from July 2019, according to Census Bureau data today.

They’re the pros in the housing market, and they’re taking advantage of homeowners’ refusal to adjust their price expectations to reality, and so sales of new single-family houses have held up well, even as sales of existing houses have plunged to the lowest levels since the depth of the Housing Bust (in July -27% from the same period in 2018 and 2019).

The seasonally adjusted annual rate of new house sales jumped by 10.6% in July from June, and by 5.5% year-over-year, to a rate of 739,000 sales, the highest since May 2023.

The big publicly traded homebuilders have figured out how to deal with this market. Unlike homeowners sitting on vacant houses, they cannot outwait this market (though a small builder might try that). Big builders have to build and sell houses to keep their revenues flowing, and they’re doing it.

They’re selling at a good clip, and they’re building at an even better clip, with unsold completed houses on the market now piling up, which is exactly what this market needs, though it’s a risky calculation for homebuilders.

Homebuyers who are frustrated with trying to buy an existing house, can go out and make a deal for a move-in ready new house, at a lower-than-market mortgage rate that the homebuilder bought down, and come out with lower payments.

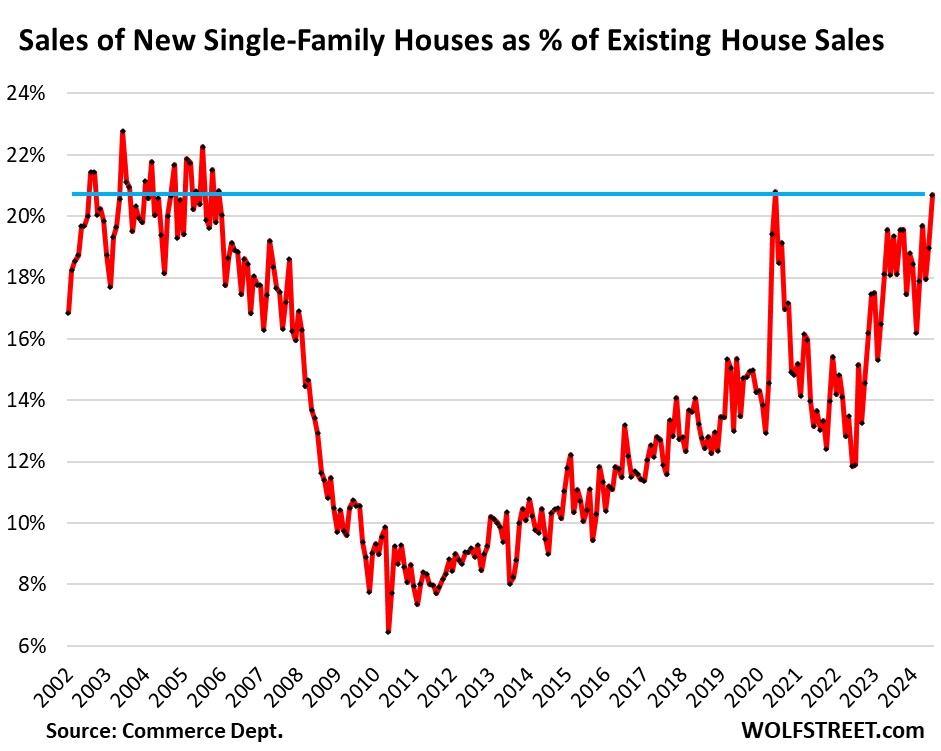

Homebuilders’ sales take an ever-larger share from homeowners.

Sales of new houses as a percentage of existing house sales in July jumped to 20.7%, the highest since 2005 (except for the lockdown spike in June 2020), as some buyers have shifted from existing houses to new houses.

This aggressiveness by homebuilders will help tamp down prices as it adds supply to the overall housing market, even as demand for existing houses has plunged.

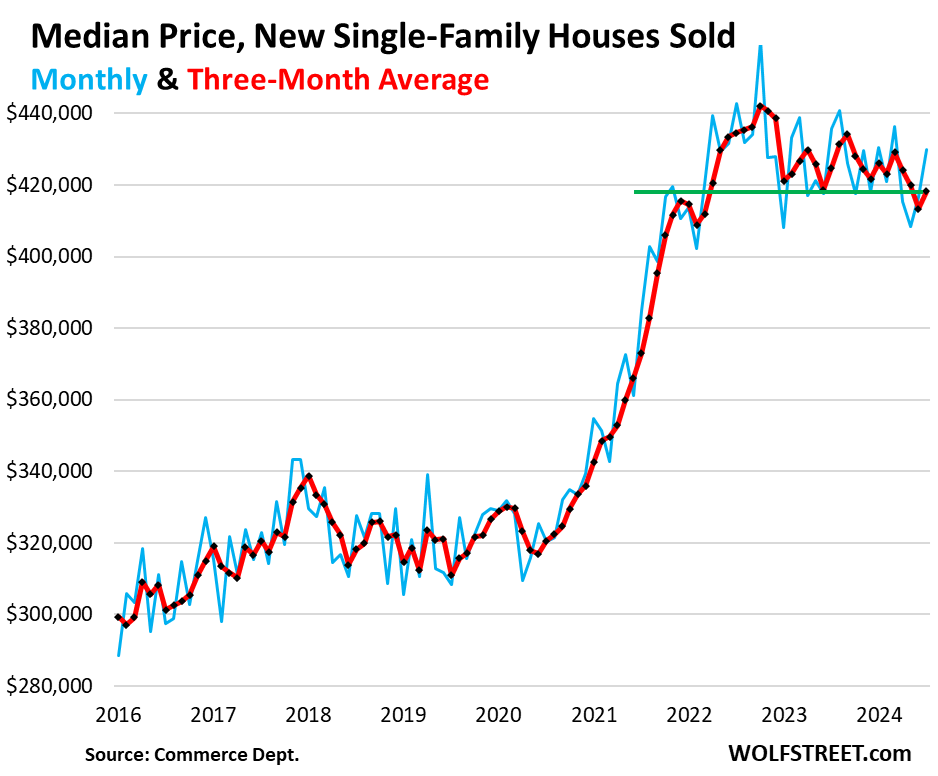

Prices of new houses have dropped and are competitive with existing house prices.

Prices of new single-family houses sold at all stages of construction have been wobbling lower since the peak in late 2022, as builders are offering houses at lower price points – smaller, less fancy houses, and less fancy appliances and finishes – and they’re throwing in big incentives, including mortgage-rate buydowns, which are costly for builders. For example, Lennar disclosed that mortgage-rate buydowns cost $47,100 per house on average.

But the prices here a contract prices, as written into sales contracts, and the costs of mortgage-rate buydowns are not included here.

The median price of new houses (based on contract prices) is subject to large monthly up-and-down squiggles that are often heavily revised, so we focus on the three-month moving average of the median price, which includes all prior revisions, and irons out some of the monthly squiggles.

This three-month average of the median price of sales contracts ticked up to $418,300 in July, down by 1.6% from July 2023, and down by 3.8% from July 2022, and down by 5.4% from the peak in October 2022:

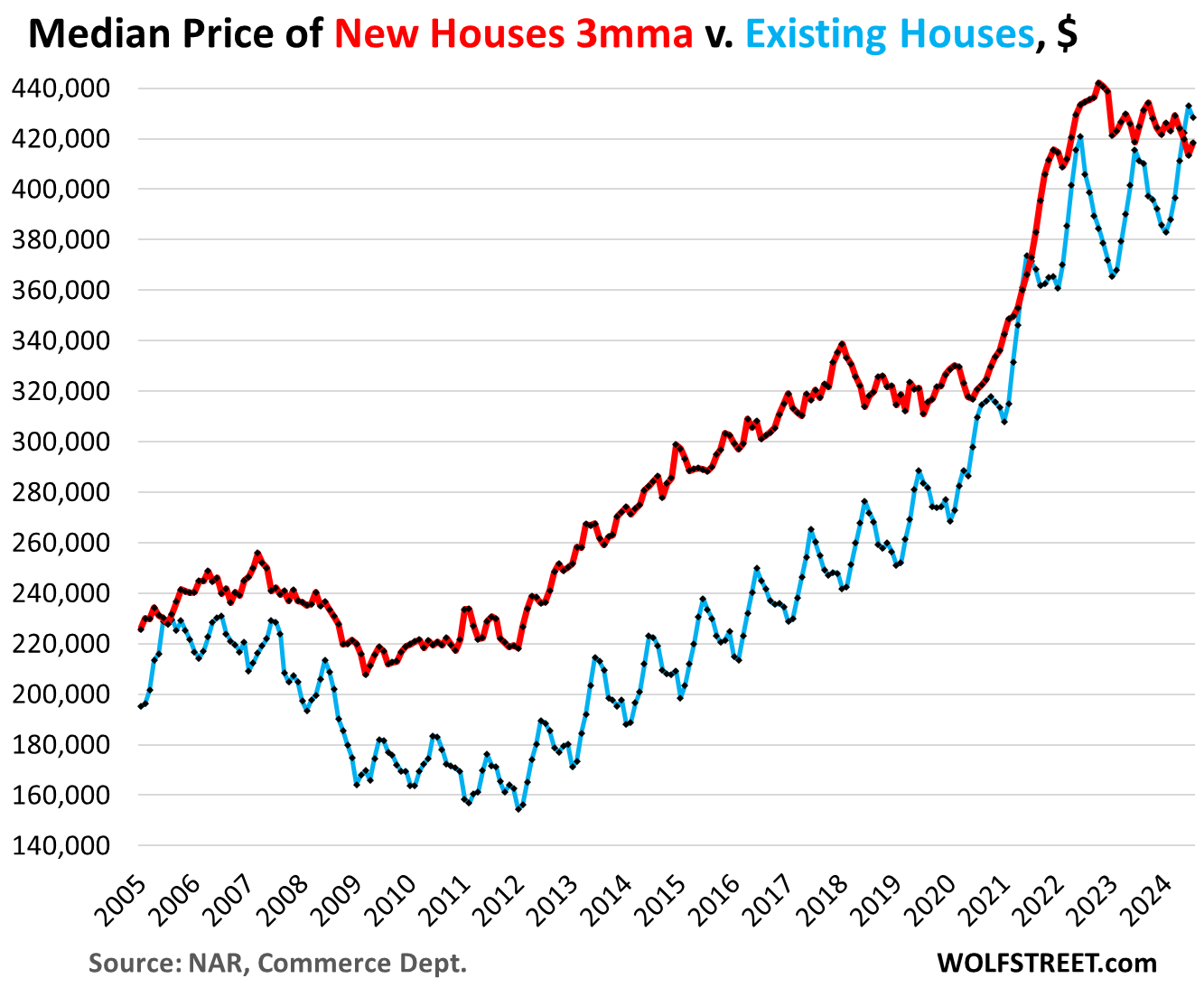

By comparison, the three-month-average median price of new houses (red in the chart below) is roughly $10,000 lower than the median price of existing single-family houses. For seasonal reasons, the median price of existing houses will drop for the rest of the year (blue):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()