Plus500 Ltd (LON:PLUS), a multi-asset fintech group, today announced its interim results for the six-month period ended 30 June 2024.

Plus500 delivered a strong financial performance in H1 2024. Revenue and EBITDA grew year-on-year, by 8% and 6%, respectively, and the Group’s cash position passed the $1 billion mark for the first time as of 30 June 2024.

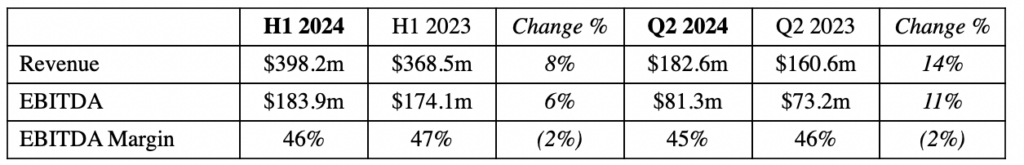

Revenue in H1 2024 was $398.2m (H1 2023: $368.5m), comprising $369.1m in trading income and $29.1m in interest income, including revenue of $182.6m in Q2 2024 (Q2 2023: $160.6m). EBITDA for H1 2024 was $183.9m (H1 2023: $174.1m) equating to an EBITDA margin of 46% (H1 2023: 47%), including $81.3m in Q2 2024 with EBITDA margin of 45% (Q2 2023: $73.2m and 46%, respectively).

Customer Income, a key measure of the Group’s underlying performance, improved during H1 2024 to $329.4m (H1 2023: $304.3m), including $159.8m in Q2 2024 (Q2 2023: $146.5m).

Customer Trading Performance was $39.7m during H1 2024 (H1 2023: $41.9m), including $9.1m in Q2 2024 (Q2 2023: $(8.2m)). The Group continues to expect that the contribution from Customer Trading Performance will be broadly neutral over time.

Net profit in H1 2024 was $148.8m (H1 2023: $146.5m) and basic EPS increased by 18% to $1.90, compared to H1 2023 (H1 2023: $1.61).

Net financial income amounted to $3.5m in H1 2024 (H1 2023: $2.6m). A substantial proportion of the Group’s cash is held in US dollars in order to provide a natural hedge, thereby reducing the impact of currency movements on financial expenses.

Total assets were $1,106.0m at the end of the period (H1 2023: $940.1m), with equity of $701.8m, representing approximately 63% of the balance sheet, following the shareholder distributions in H1 2024.

The Group remained debt-free and held cash and cash equivalents of $1,007.2m as of 30 June 2024 (30 June 2023: $849.0m; 31 December 2023: $906.7m).

Since the Company’s IPO on the London Stock Exchange in 2013, Plus500 has generated over $3.4bn in cash from operations, $2.7bn in accumulated net profit and distributed $2.3bn in shareholder returns, including those announced today.

David Zruia, Chief Executive Officer of Plus500, commented:

“Plus500 has delivered strategic, operational and financial progress during H1 2024 and I am proud of what we have achieved. We continue to be guided by our strategic ambitions – to expand into new markets, develop new products and deepen engagement with our customers.

We delivered growth in revenue and EBITDA, continued to expand our geographic footprint, developed innovative new products and, as a result, saw an increase in new and active customer numbers year-on-year. Plus500 remains strategically well positioned to capitalise on both short-term market conditions and the medium-term growth trends in our end markets. The proprietary nature of our technology is what differentiates Plus500, creating an exceptional experience for our customers.

Thanks to our strong fundamentals and highly robust financial position, we are delighted to announce today significant additional shareholder returns of $185.5m and we expect FY 2024 results to be ahead of current market expectations.”