This article first appeared in The Edge Malaysia Weekly on August 5, 2024 – August 11, 2024

KUWAIT Finance House (M) Bhd (KFH Malaysia) intends to sell its retail banking portfolio — which includes some RM2.7 billion worth of financing assets, comprising mainly mortgages — as part of its exit plan from the country.

In an exclusive interview with The Edge, acting CEO Ida Aizun Husin says KFH Malaysia will issue a request for proposal “in the next couple of months” to solicit bids from prospective buyers such as banks.

“We’re in the midst of finalising that. It has to go through the regulatory process first,” she says of the plan to divest the retail portfolio.

KFH Malaysia is a predominantly retail banking-focused group. A check of its recently released audited financial statements for the year ended Dec 31, 2023 (FY2023) showed that around 73% of its total gross financing of RM3.62 billion was extended to individuals.

The retail banking portfolio is considered the “gem” within the group and will be sold to the highest bidder.

“Our main objective is to get the best value [for it], considering that we have developed a strong retail banking [business] over the years,” Ida Aizun says.

“As of end-2023, our retail financing assets were at about RM2.7 billion, comprising both performing and non-performing assets. We are going to bundle [these] together in the sale.

“The biggest component of the assets is mortgages, but there is also auto and personal financing. Retail CASA (current account, savings account) deposits — which stood at over RM400 million as at end-2023 — will also be included as part of the retail portfolio sale,” she reveals. (Retail deposits include individual and small and medium enterprise accounts.)

Apart from retail banking, KFH Malaysia has two other businesses — namely, corporate banking and treasury.

“In treasury, we have very good rated sukuk amounting to about RM3.8 billion as at the end of last year. We will let these run their natural course.

“As for corporate banking, our outstanding financing assets are quite small, at around RM800 million to RM900 million, and are mainly related to working capital, mostly within manufacturing. We will offboard [most of] these naturally [that is, let them run until their tenure naturally concludes],” she says.

Of the corporate banking financing assets, the non-performing portion — which amounts to “around RM100 million to RM200 million” — will be carved out and disposed of to prospective buyers such as debt collection agencies or financial institutions, she adds.

The group does not plan to sell its corporate and non-individual deposits. These will remain with the bank until their tenures mature. “These accounts can continue to roll over until their tenure naturally concludes, similar to [what we have in mind for] our corporate banking clients,” she says.

Ida Aizun, who is also the senior vice-president of corporate banking, was appointed the acting CEO in June after Mohd Hazran Abd Hadi, the CEO, left to pursue personal endeavours.

An orderly exit

Ida Aizun assures that KFH Malaysia is committed to seeing through the winding down of its operations in an orderly manner for all stakeholders. The group aspires to completely exit Malaysia “sometime in 2025”, but will not rush the process.

“There is a process we will have to follow through, and we won’t rush it because there are many stakeholders that we have to take care of. We are working with a couple of advisers — appointed by the shareholder — as we want to do things right,” she says, declining to name the advisers.

Last Wednesday (July 31), KFH Malaysia’s sole shareholder — Kuwait Finance House KSCP (KFHK), the world’s second-largest Islamic lender by assets — announced that it had decided to voluntarily withdraw from the Malaysian market, confirming an earlier report by The Edge about the impending exit.

It said the decision to exit followed an international business strategic review to focus on and expand in the Middle East. In a statement, KFH Malaysia stressed that it remained profitable and on a sound financial footing. It said it would explore the potential sale “of certain portfolio segments”, without elaborating further.

According to KFH Malaysia’s FY2023 audited financial statements released later that same day, KFH had formally notified Bank Negara Malaysia on July 18 last year of its intention to exit the Malaysian market, after having undertaken the exercise to “ascertain the best strategic alternative for KFH Malaysia”.

Then, on Nov 2, KFH Malaysia’s board of directors had approved the governance structure and preliminary wind-down approach and strategy in relation to the exit plan. The group will eventually return its banking licence to Bank Negara as per regulatory requirements.

Apart from Malaysia, KFHK does not have a presence in Asia. It has operations in Bahrain, Türkiye, Jordan, Saudi Arabia as well as affiliates in the United Arab Emirates.

Asked why the group had not considered a bank merger as an exit option, Ida Aizun says: “The mandate that we got from the shareholder was that they had decided on a wind-down, and that it would have to be done right. So, that’s the plan we now execute at the management level.”

Despite speculation to the contrary, KFH Malaysia has never held M&A discussions with any bank throughout its 19-year history in Malaysia, she shares.

KFHK has injected into KFH Malaysia around RM1.4 billion in capital, cumulatively, over the years, she says.

Key staff were informed of the exit earlier, while most were told of it during a town hall session last Wednesday (July 31). According to Ida Aizun, KFH Malaysia has slightly over 300 employees, of which 288 are permanent staff.

“Staff welfare is very important. We have come up with a redundancy separation scheme. It will be for all permanent staff and it will be done in phases, to be in line with how we offboard our portfolio. The package is above the statutory requirement,” she says, without elaborating. The group will also assist staff with job placement related services such as résumé preparation and so on.

KFH Malaysia’s headquarters, including its main branch, is in Menara Prestige in Jalan Pinang, Kuala Lumpur, where it takes up five floors. KFH Malaysia does not own buildings, Ida Aizun says. “We rent, including our branches.”

Volatile earnings over the years

Analysts and industry observers The Edge spoke to said they were not entirely surprised the group is exiting the Malaysian market. The going has been tough for KFH Malaysia from the start.

It had the distinction of being the first and largest financial institution from the Middle East to set up operations here after Malaysia opened up its Islamic banking sector to foreign players. It commenced operations in August 2005.

However, like the other Middle East lenders here, it struggled to make notable strides, in part due to the tough competition from local rivals, many of which have the benefit of larger balance sheets and retail networks.

KFH Malaysia’s problems were compounded by a lack of strong leadership and lax risk management practices in the early years, critics say. In FY2009, it posted its first loss of RM30.88 million amid a sharp deterioration in asset quality. Its gross impaired financing ratio shot up to 8.64% from just 0.32% in 2008.

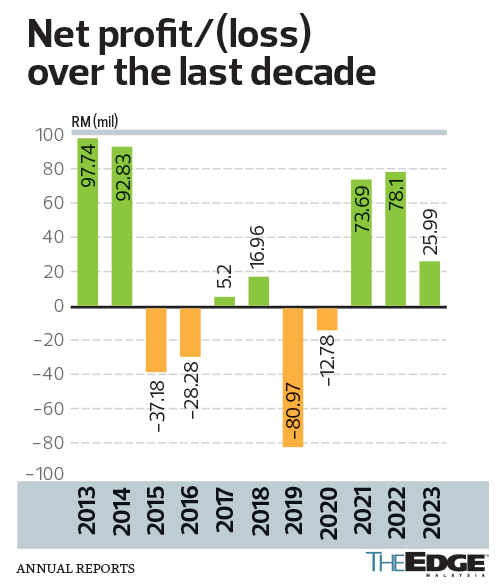

Over the subsequent years, the group continued to be in and out of losses. It posted losses in seven of 19 years, according to a banking analyst.

Nevertheless, Ida Aizun points out that the group has always managed to bounce back. The group has made good profits over the last three consecutive years, she says (see chart).

Asked why it has been so tough for the group to be consistently profitable, she cites efficiency and cost as having been particularly challenging for the industry. “That has been challenging for many banks, in fact. But a focus [on addressing that] is also how we have pulled through [and bounced back] from the losses we generated from earlier on. I think in terms of competition, we have actually positioned ourselves pretty well. It’s a good brand we have and we’ve improved a lot from past years.”

In FY2023, its profit before tax rose 22.7% year on year (y-o-y) to RM88.1 million on the back of higher revenue of RM371.6 million compared with RM364.9 million a year ago. Its net profit, however, fell to RM25.99 million from RM78.1 million in FY2022 and RM73.69 million in FY2021.

It had a writeback of credit loss on financial assets of RM25.03 million in FY2023 compared with a credit loss charge of RM31.38 million in FY2022.

KFH Malaysia’s gross non-performing financing ratio stood at 6.2% as at end-2023, a slight deterioration from 6.82% a year earlier. Its retail gross NPF ratio stood at 1.87% compared with 1.74% the year before.

KFH Malaysia’s total assets stood at RM7.66 billion, having dwindled from RM10.79 billion in FY2016.

Some of the country’s smaller Islamic banks are likely to be interested in KFH Malaysia’s retail portfolio that will be up for sale, a banking analyst says. “It probably won’t interest the bigger banks as the amount for sale is relatively small, and won’t move the needle [for them],” he remarks.

Channel checks by The Edge of a few Islamic banks show they are keen to know more about the retail asets for sale and how “clean” they are.

There are currently 17 Islamic lenders in Malaysia, of which six are foreign. In May, a new Islamic digital bank — Aeon Bank — was added to the mix, making it a crowded market where net financing margins have also been on a decline.

Upon KFH Malaysia’s exit, the only remaining foreign standalone bank will be Al Rajhi Banking & Investment Corp (M) Bhd. National Bank of Abu Dhabi Malaysia Bhd, which set up operations here in July 2012, closed six years later in 2018.

As for Asian Finance Bank Bhd, it was acquired by Malaysia Building Society Bhd (KL:MBSB) in April 2018.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.